Another wave of pain has hit crypto traders. China just slapped tariffs on U.S. agricultural goods, worth nearly $22 billion. Markets did not take it well. The S&P 500 dipped lower, and crypto wiped out four months of gains in hours.

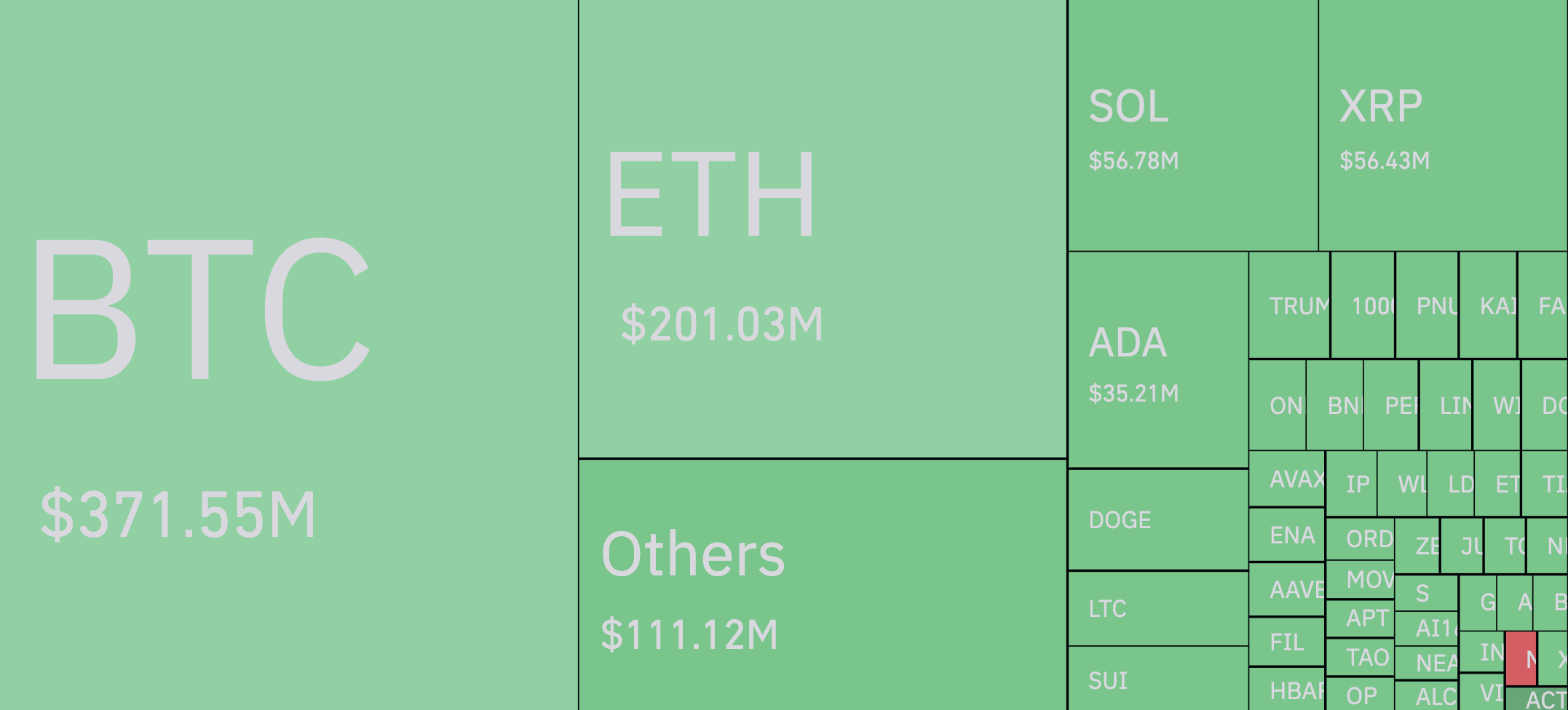

Liquidations surged. In 24 hours, the crypto market saw $1 billion in liquidations, according to CoinGlass. The worst part? Most of it hit long positions. XRP, Cardano (ADA) and Dogecoin bulls felt the impact the hardest. About 70% of liquidations were longs, leaving only 30% in shorts. It is a major reminder of how fast leverage can turn against traders.

This was not just a crypto story, though. Equities were not spared either. The S&P 500’s drop reflected broader market fears - trade tensions, economic uncertainty, risk-off sentiment creeping back in. It all fed into a cycle of selling. And crypto, still tethered to macro trends, took a hit along with it.

XRP, ADA, DOGE - these names have seen steady accumulation over the past months. That momentum is gone, at least for now. Liquidations unraveled leveraged positions, leaving traders reassessing their exposure.

The mood has shifted, with confidence shaken. A market that had been clawing its way back is now facing renewed volatility. Crypto traders are watching and waiting. Will there be a bounce? Or will uncertainty keep prices under pressure?

One thing is clear: risk remains. Leverage cuts both ways, and this time, it is crypto bulls paying the price.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov