Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

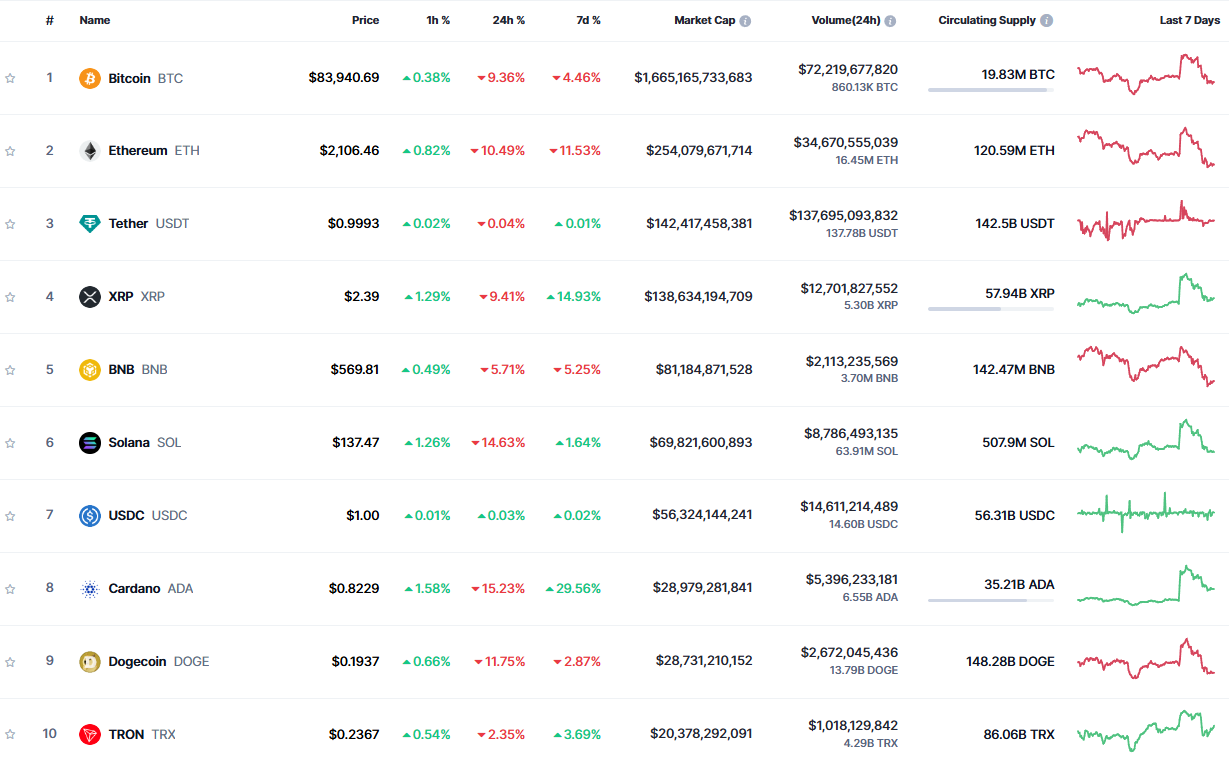

Over the last 48 hours, the cryptocurrency market has undergone a violent reversal, losing almost $500 billion in market capitalization. Three of the most popular altcoins, Dogecoin, Solana and XRP, have experienced drops of up to 20%, leaving traders perplexed. A startling series of events led to the sharp decline on the market.

On Sunday, the establishment of a U.S. Cryptocurrency Reserve was declared, setting off a surge of optimism. The cryptocurrency market capitalization recovered most of its recent losses as a result, rising from $2.77 trillion to $3.11 trillion.

The market, however, abruptly turned around in the next day and fell back to $2.6 trillion, which was $100 billion less than its pre-announcement level. Many investors were unprepared for this sudden change, which brought to light the cryptocurrency market's extreme volatility and speculative nature. Ethereum is a great example of the market's quick turnaround.

Prior to the reserve declaration, ETH had slumped to $2,173. After the announcement, it surged to $2,550 but then fell back to $2,050, which was 8% lower than its pre-announcement level. A significant change in investor sentiment is reflected in this type of extreme volatility, which transforms what looked like a bullish catalyst into a painful bull trap.

The Crypto Fear and Greed Index was at 20 prior to the announcement, indicating Extreme Fear. It soared to 55, almost to Greed, after the reserve news. The fact that it is now back down to 24 shows a total reversal of sentiment.

Record capital outflows from cryptocurrency funds last week totaled $2.06 billion, which is $500 million more than the previous record set in 2024, further contributing to the pessimistic outlook. Investors are quickly withdrawing their money from cryptocurrency, in spite of the reserve's ostensibly optimistic announcement.

The main cause: a worldwide trend toward riskier assets. Trade wars and economic uncertainty are driving investors away from speculative markets. Oil and stock markets, among other traditional markets, have also experienced a decline. While Bitcoin has decreased by 10% so far this year, safe-haven assets like gold have increased by 10%. Recent price activity indicates that the market is under pressure from the macroeconomic environment, even in the face of significant bullish catalysts.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov