Payment processing giant Visa has made it possible for each of its banking clients to offer Bitcoin services with the help of its newly launched API pilot program.

Banks will grant their customers exposure to Bitcoin via its cryptocurrency partner, Anchorage.

During a recent earnings call, Visa CEO Al Kelly claimed that his company was "uniquely positioned" to make cryptocurrencies safer and more applicable for payments:

In this space, we see ways that we can add differentiated value to the ecosystem. And we believe that we are uniquely positioned to help make cryptocurrencies more safe, useful and applicable for payments through our global presence, our partnership approach and our trusted brand.

Advertisement

Last month, Anchorage—which was launched back in 2017 as a custody solution—achieved a seismic shift in the cryptocurrency industry by obtaining a federal bank charter from the U.S. Office of the Comptroller of the Currency. With Visa on board, there are now significantly fewer roadblocks for big banks that want to hold digital assets.

Apart from custody, it now offers other cryptocurrency-related services such as trading and lending.

Bitcoin is worth more than Visa

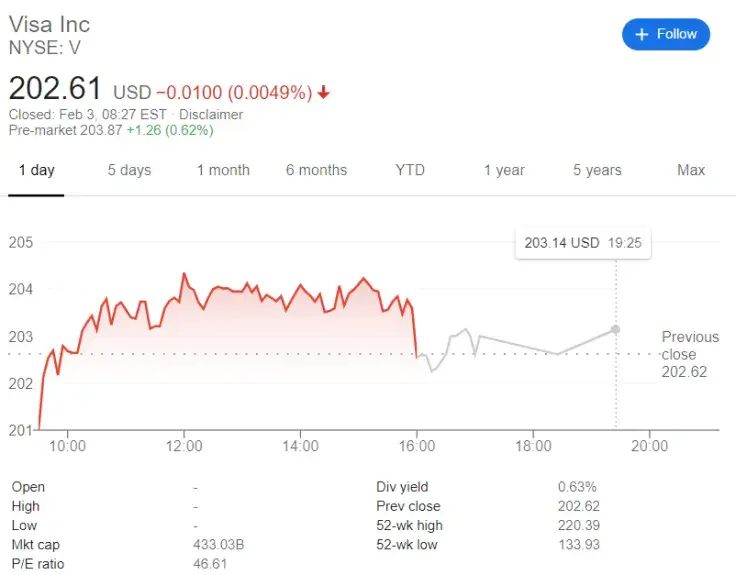

In December, Bitcoin achieved a major milestone by surpassing the total market cap of Visa for the first time since late 2017.

As of now, its current market cap is sitting at $680 billion as opposed to Visa's $433 billion.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin