Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

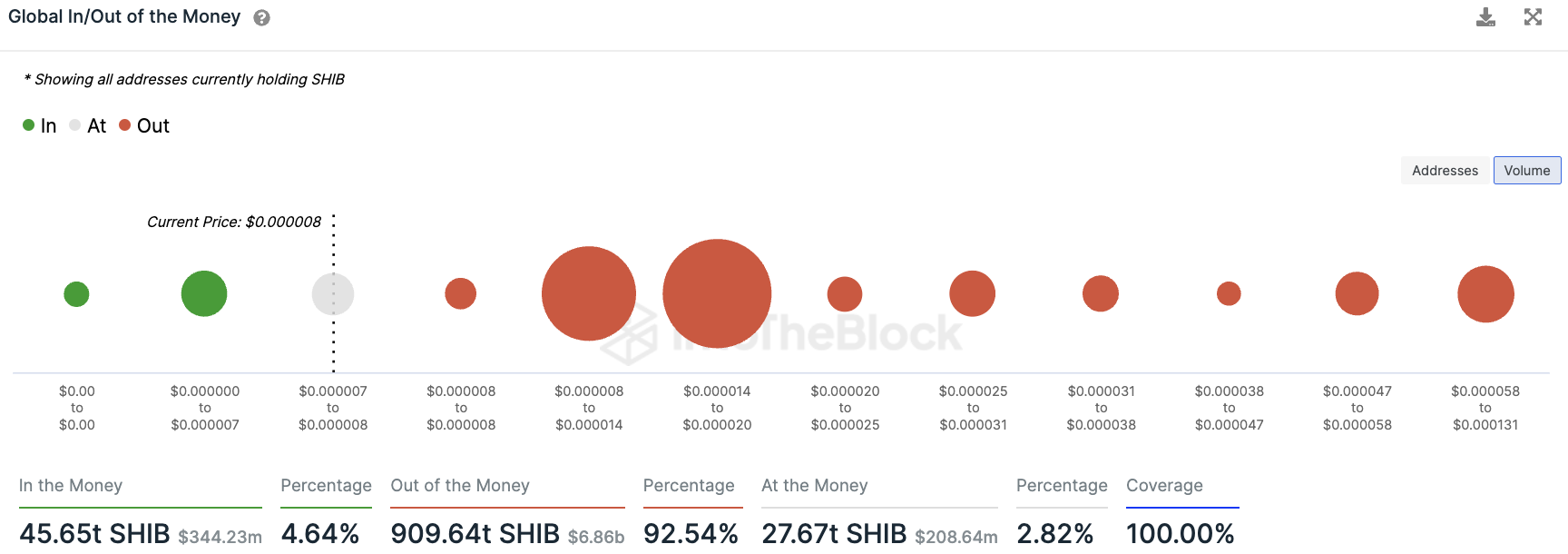

The Shiba Inu token, known for its popularity among crypto enthusiasts, is facing a major setback as the percentage of tokens carrying losses to their holders has surpassed a critical threshold. According to crypto analytics portal IntoTheBlock, over 90% of the total SHIB supply is currently incurring losses, with an additional 2.54% on top.

As of today, the number of Shiba Inu tokens causing losses to their owners stands at a staggering 500 trillion, excluding the 410.3 trillion burned tokens. This accumulation of unprofitable tokens amounts to a jaw-dropping value of approximately $3.77 billion, based on the current price of the Shiba Inu token.

To further highlight the severity of the situation, Shiba Inu now ranks fifth among crypto assets with a capitalization above $1 billion in terms of this unfavorable ratio. The majority of these loss-bearing SHIB tokens were acquired within the price range of $0.000008 to $0.00002 per token. Notably, 290.89 trillion tokens were purchased between $0.000008 and $0.000014, while 424.07 trillion tokens were acquired between $0.000014 and $0.00002.

This emerging trend presents a significantly negative outlook for the Shiba Inu token. It is not merely the fact that SHIB is characterized as a loss-making token, but rather the immense pressure it currently faces. Should even a fraction of owners holding unprofitable SHIB tokens decide to cut their losses and offload their holdings, it could potentially trigger a more substantial downturn for Shiba Inu.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov