Decentralized exchange Uniswap has become the biggest gas spender on the Ethereum network, according to data provided by EthGasStation.

The protocol has now surpassed Tether (USDT), the largest stablecoin in terms of gas consumption, with $6.99 mln and $6.39 mln worth of fees accrued over the last 30 days, respectively.

A booming decentralized exchange

Unlike centralized and decentralized exchanges with orderbooks, Uniswap relies on automated market makers (AMMs) and liquidity pools.

Uniswap users are required to pay a 0.3 percent fee for executing a trade. These fees then get divvied up by liquidity providers.

On Aug. 10, Uniswap tied Bitcoin, the number one cryptocurrency network, when it came to total fees paid in one day.

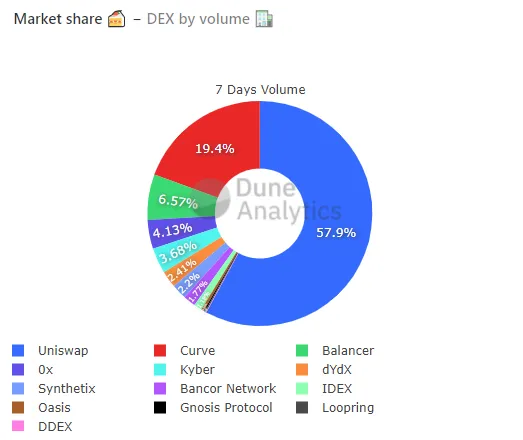

Dune Analytics data shows that Uniswap V2 is responsible for the lion's share (57.9 percent) of all trading volume logged by DEXes over the past 24 hours. Curve, a similar exchange designed for stablecoin trading, comes in a distant second place with a 19.35 percent share.

Scams continue to clog Ethereum

SmartWay Forsage, a high-risk dApp that is labeled a scam by EthGasStation, is the third-largest gas spender on the Ethereum network.

The Ponzi scheme, which attracted the attention of the Philippines' Securities and Exchange Commission (SEC) in July, was harshly criticized by Ethereum co-founder Vitalik Buterin, who compared it to BitConnect:

This kind of projects relies on more and more people coming in to pay the previous participants every day. When the new participants are gone, most users lose everything they invested. Look at BitConnect, OneCoin, etc… I ask you to leave and do not contest the Ethereum ecosystem in the future, thanks!

Forsage operators, however, insist that they are actually making Ethereum prosper by boosting activity on the network.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov