Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In a recent analysis, renowned crypto analyst Ali Martinez has sounded the alarm on potential obstacles looming over the surging Shiba Inu (SHIB) token.

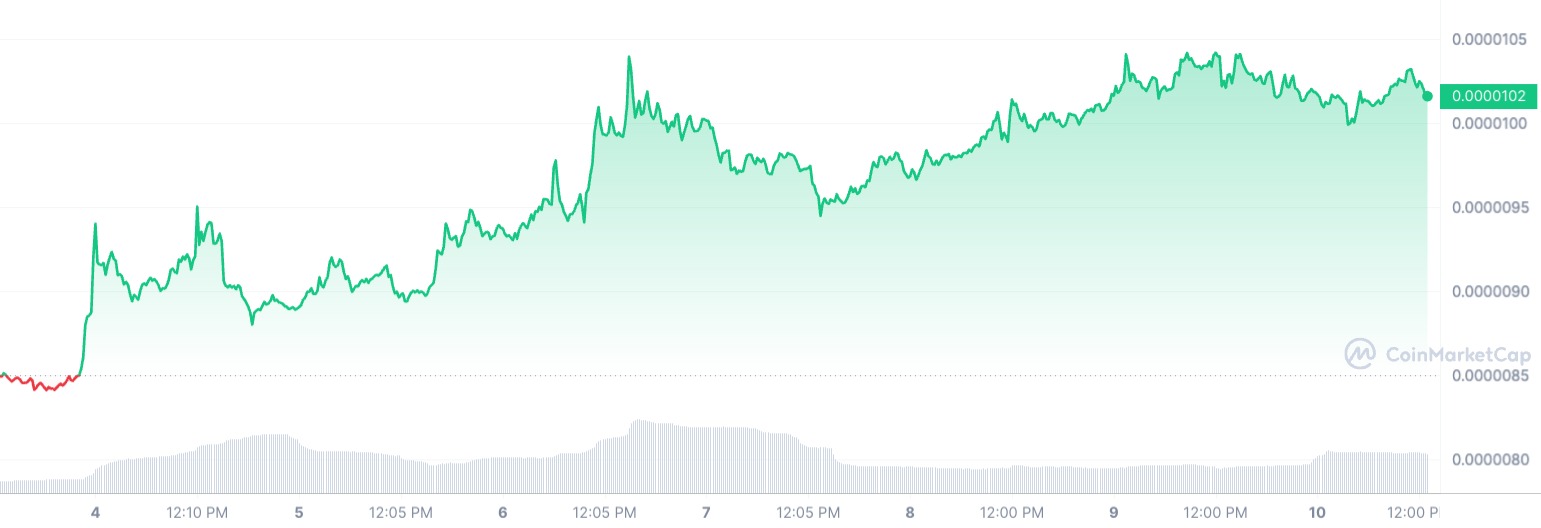

Despite the meme coin's impressive 55% growth over the past three months, Martinez's concerns are centered around a significant hurdle that could jeopardize SHIB's future growth trajectory.

Martinez's analysis, relying on data from IntoTheBlock, reveals an eye-watering concentration of 422 trillion SHIB, held by nearly 90,000 addresses at an initial price of $0.000016. The sheer volume of these tokens, if unloaded simultaneously, could unleash a wave of selling pressure capable of denting SHIB's price and disrupting its current bullish momentum.

The apprehension arises from the potential consequences of such a massive sell-off. If these large-scale holders decide to liquidate their SHIB holdings, the market could be flooded with tokens, triggering a substantial price correction.

Adding to the complexity is the fact that these addresses are currently holding SHIB at a loss, intensifying the pressure on the token's value.

Break point

The burning question now is whether Shiba Inu can navigate this hurdle and sustain its growth. Despite the looming threat, SHIB has already experienced a commendable 22% surge since the beginning of December, breaching the coveted $0.00001 per SHIB mark.

Nevertheless, the presence of this colossal concentration of tokens in whale wallets injects an element of uncertainty, casting doubt on the durability of SHIB's ongoing bullish run.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin