In a newly released report, fintech giant Ripple has outlined in detail the inefficiencies of the legacy banking system when it comes to cross border payments for SMEs.

“SME needs with cross border payments are largely unmet by traditional systems”

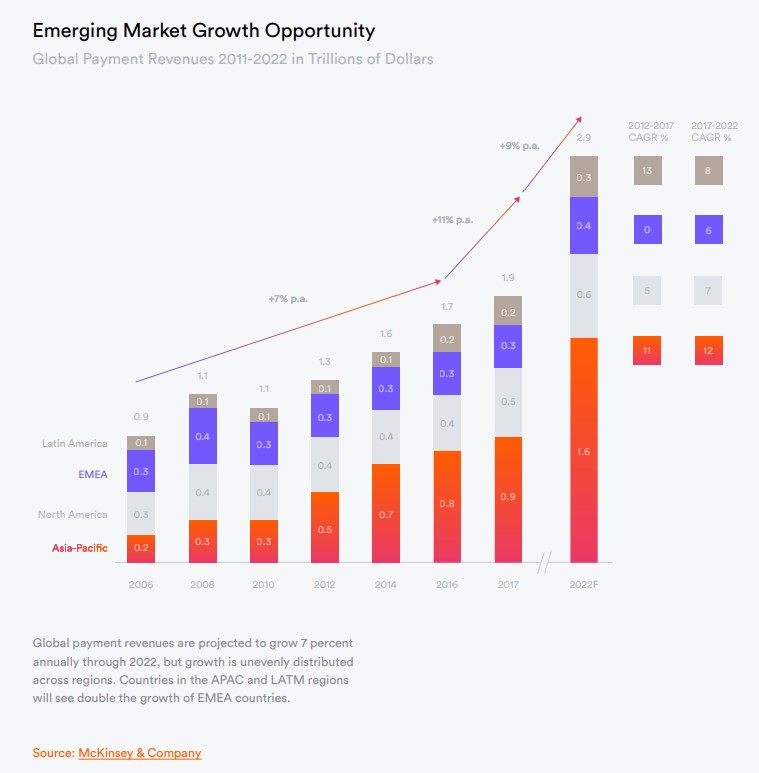

The report states that in the recent years (since 2016 up to now), the industry of cross-border B2B payments for SMEs and remittances has witnessed a massive growth.

The main growth and expansion has been taking place in emerging markets in particular.

Despite the recent major rise, the report states, the SME B2B market of cross-border payments has been stunted by lack of traditional financial services.

In details: there are extremely high fees for international payments and in some areas there is no one to offer these services at all.

Over the past five years, and especially over the past pandemic year, multiple workers have been working from homes or work is being outsources, as well as a lot of people are purchasing from online stores, including food and other basic everyday goods, the need for quick and safe online payments has soared compared to the period before the pandemic arrived.

SMEs rely on cross-border payments to expand their business and land new clients.

Another drawback of the current cross-border payment systems is a large number of intermediaries.

All these nuances may have a negative impact on the ability of SMEs to scale their business and to simply maintain it.

SME pain points as the reports lays them out

• Limited visibility into the total costs and timing of payments

• No traceability when the payment will actually arrive

• Settlements slowed down by transfers through correspondent banks

• Very expensive foreign exchange spreads and fees

Cost of B2B payments via the traditional system

• 2-5 days to settle on average

• $30-$100+ cost per transaction

• 4-6% international payment error rate

Ripple announces new ODL corridors in the UK and Brazil

Ripple reminds that the blockchain tech can solve all the aforementioned issues, in particular RippleNet and ODL-service based on it.

The company has also made a reminder that recently, two of its clients, InstaReM (based in the UK) and BeeTech (based in Brazil) have set up new ODL payment corridors for fast and cheap cross-border payments to Portugal, Germany, Spain, France and Italy.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov