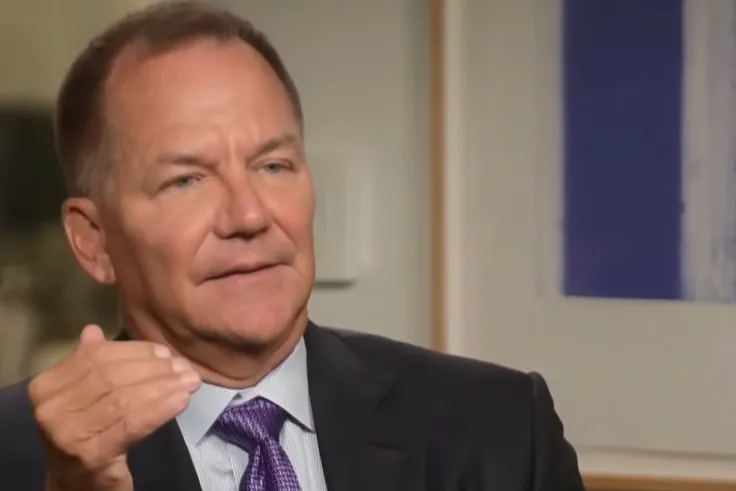

Billionaire Paul Tudor Jones spoke about Bitcoin's role as an investment hedge during his Wednesday appearance on CBNC, claiming that it is currently winning the race against gold:

I do think that we are moving into an increasingly digitized world. Clearly, there's a place for crypto, and clearly, it's winning the race against gold.

Hence, the legendary hedge fund manager claims that crypto would be "a very good" inflation hedge.

Gold is down 6.95% year-to-date, while Bitcoin is up 121%.

Speaking of the launch of the very first Bitcoin futures exchange that took place yesterday, Jones said that he preferred owning physical Bitcoin:

I think that a better way to get in would be to actually own physical Bitcoin.

Advertisement

The prominent American investor disclosed his Bitcoin position back in May 2020, which was widely seen as a watershed moment for the benchmark cryptocurrency, given that his words are closely followed by asset managers around the world.

Jones says that he still has crypto in the single digits in his portfolio.

"The single biggest threat"

Jones also opined that inflation is not transitory, adding that it is the biggest threat faced by society:

I think to me the number one issue facing Main Street investors is inflation, and it's pretty clear to me that inflation is not transitory.

He also slammed the Federal Reserve for conducting "the most inappropriate" monetary policy throughout his lifetime.

Jones describes Fed chairman Jay Powell as an "inflation creator" because the central bank is still doing quantitative easing.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin