Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

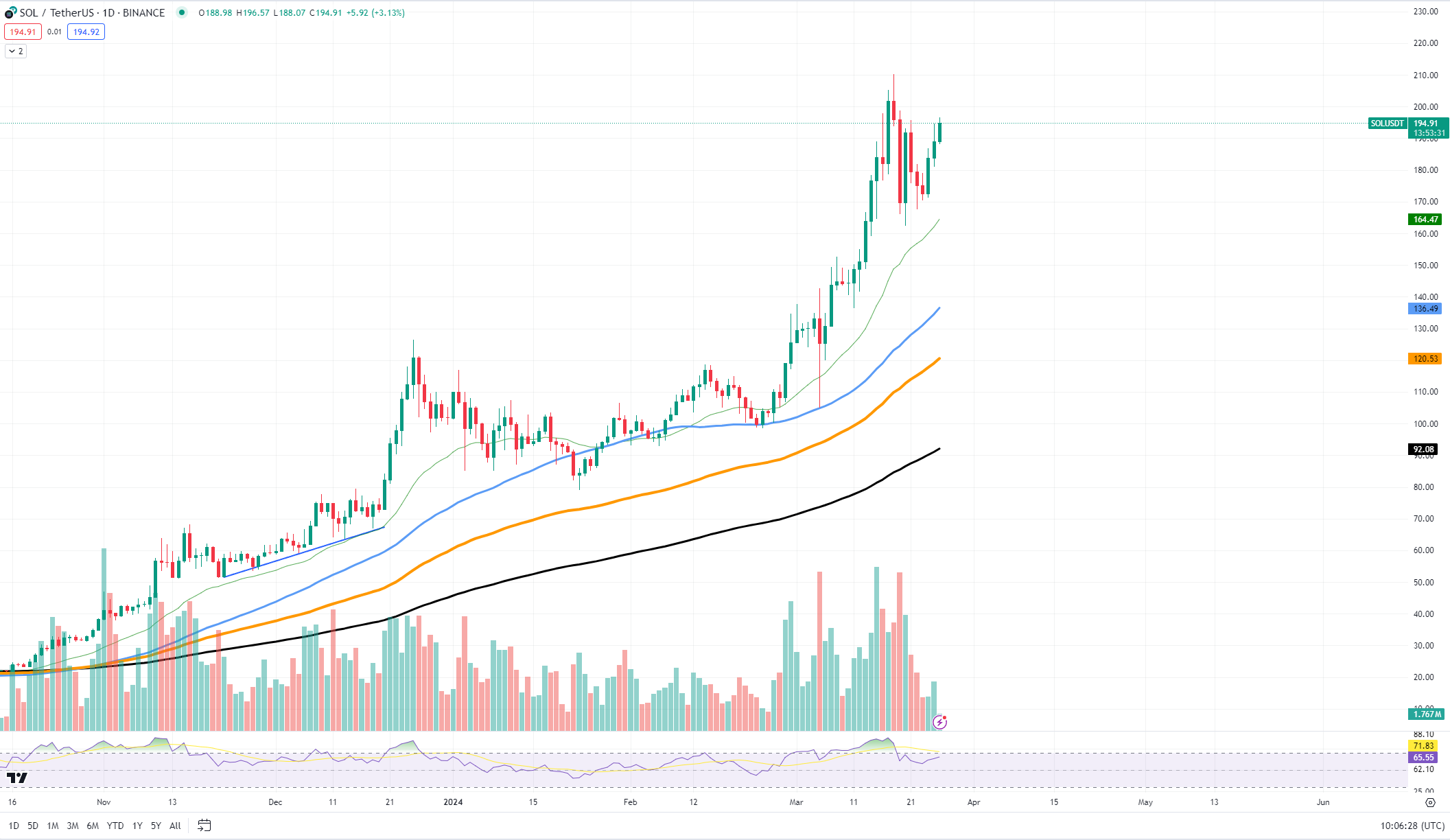

New Solana-based meme coin MEW is the hottest topic among meme enthusiasts as it has gained enormous traction on the market . A trader's investment of 5,490 SOL, equivalent to $1.07 million, to acquire 9.58 billion MEW, amounting to 10.8% of the total supply, has emerged as the biggest single purchase of this coin, positioning them as the largest buyer and holder. The trader's unrealized profit now exceeds $20 million. But keep in mind, there is not enough liquidity to realize all that profit.

Moreover, this trader appears to have had previous success with another altcoin, BOME, securing an approximate profit of $1.35 million. By investing 750 SOL for 94.86 million BOME and then selling 80.1 million of them for 6,550 SOL ($1.28 million), the trader's remaining 14.76 million BOME is valued at around $214,000.

While these figures may stir excitement and dreams of wealth in the crypto community, caution is crucial when navigating the meme coin landscape. These assets, often inspired by internet memes and social media trends, are known for their extreme volatility.

Particularly, Solana meme coins carry a reputation for not only their extreme volatility that leads to sharp price swings but also for being entangled in schemes that have, in some instances, drained liquidity from unsuspecting investors.

Numerous altcoins appearing in similar cycles have been implicated in deceitful activities, including liquidity drainage and complex interactions with Solana contracts, such as freezing funds and selling premines.

Potential investors should be vigilant, conducting due diligence on deployer addresses and associated wallets. It is not uncommon for a large portion of a meme coin's supply to reside in such wallets, and if those holdings were to be suddenly liquidated, the resulting sell-off could lead to severe losses for other holders.

Therefore, as attractive as the prospect of quick gains from meme coins like MEW might be, you should approach it with a level of caution and avoid moves that are too risky.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin