Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Michael Saylor, the American entrepreneur and CEO of MicroStrategy, has broken his silence amid the chaotic turmoil on the crypto market. Not surprisingly, the essence of the post was once again to show support for Bitcoin (BTC).

Known for his vocal and indisputable support for the major cryptocurrency, Michael Saylor's latest remarks only underscore his belief in the long-term potential of Bitcoin.

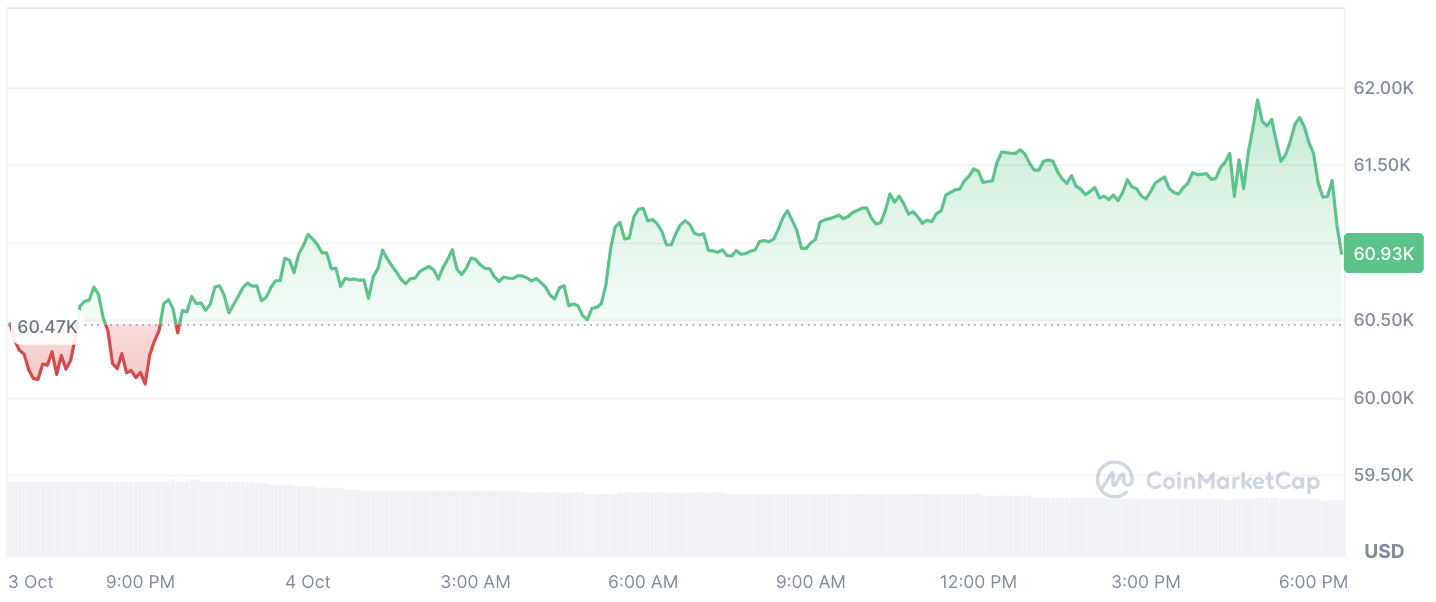

As the price of BTC has seen a quick pump off key support levels to over $62,000, the CEO of MicroStrategy has accompanied the action with just one word: "bullish". That was it for words, but it was not the whole post, as Saylor also attached an AI-generated image showing him riding a bull with the Bitcoin logo on its forehead.

This was characteristic for the businessman, and while such a social media presence may seem unconventional, the cryptocurrency itself is also unconventional, so it is the perfect match.

Roller coaster ride of Bitcoin

Ultimately, the reason behind the surge in the cryptocurrency market was the summary of the employment situation in the United States. The employment data came in better than expected, and this positive sentiment supposedly boosted the price of assets, especially cryptocurrencies.

However, it is not all sweetness and light as a strong increase in labor market activity casts doubt on the existence of any cooling. With such statistics, any sharp steps to cut the rate by 50 bps are out of the question. Rather, the question is whether the rate should be cut at all in November.

If a rate cut does not happen, the money printer that many market participants are expecting will not start anytime soon.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov