Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

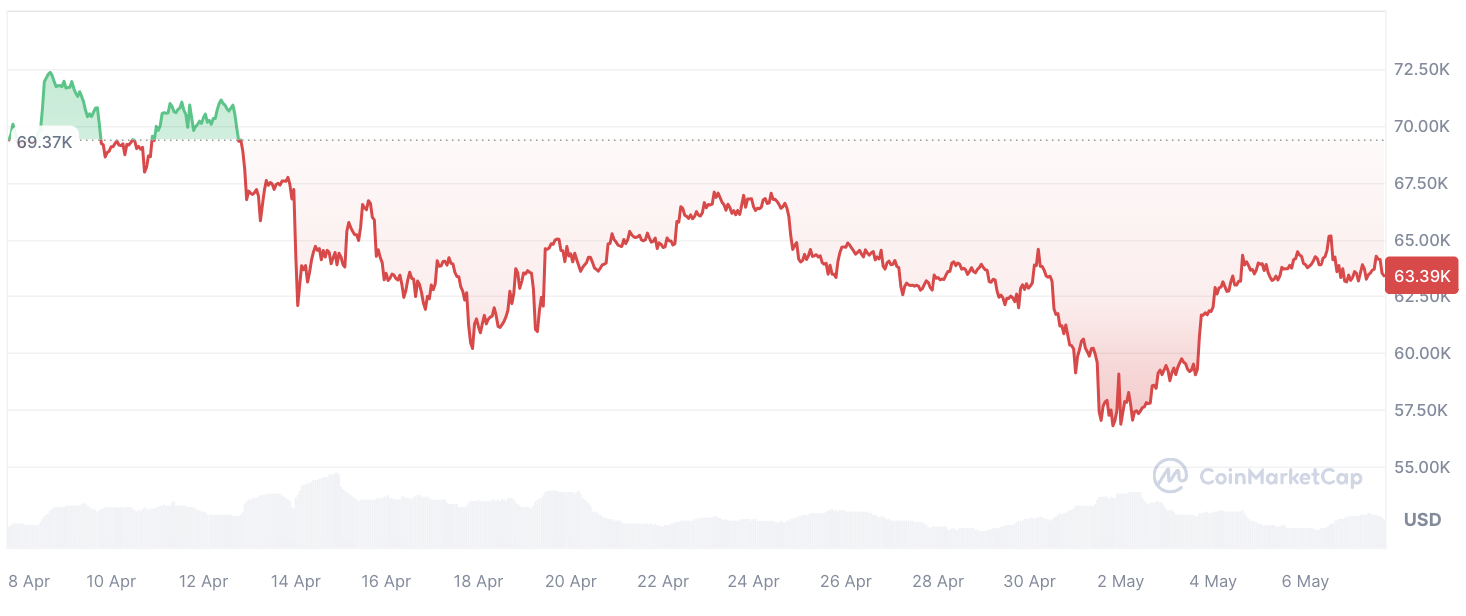

Amid a fluctuating Bitcoin price and growing concern within the crypto community, Michael Saylor, the CEO of MicroStrategy, has emerged as a beacon of bullish optimism. Over the past 24 hours, Bitcoin's value has experienced mixed movements, dropping from $65,500 to $62,830 on Monday before rebounding to $63,600 today.

However, the broader trend on the daily chart is disconcerting, with Bitcoin registering another lower high since mid-March, adding to anxiety following a recent lower low.

For those unfamiliar with trading terminology, a "lower high" occurs when the peak price of an asset is lower than the previous high, indicating a potential downward trend, while a "lower low" signifies a new trough lower than the previous low, suggesting further declines.

Despite these concerning signals, Michael Saylor remains resolute in his bullish stance. In his latest communication, he advocates for embracing bullish sentiment, urging investors to "Run with the Bulls."

Saylor's unwavering confidence in Bitcoin serves as a counterbalance to prevailing uncertainties, offering reassurance to those wavering on the cryptocurrency's future prospects.

However, cautionary tones persist, reminding investors that Saylor's optimism does not guarantee stability. The fate of Bitcoin hinges on the actions of buyers, with the potential for a collapse looming if their support falters. Analysts warn that if bearish sentiment prevails, BTC could revisit key support levels at $61,000 and the $56,000 range, where significant liquidity is concentrated.

Tomiwabold Olajide

Tomiwabold Olajide Arman Shirinyan

Arman Shirinyan Gamza Khanzadaev

Gamza Khanzadaev Yuri Molchan

Yuri Molchan