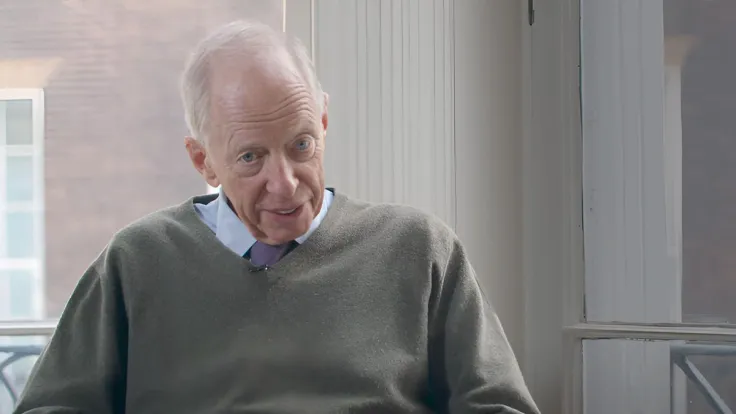

Lord Jacob Rothschild, British peer, investment banker and member of the Rothschild banking family, passed away at age 87. Despite stepping down as chairman and director of RIT Capital Partners (formerly Rothschild Investments) in 2019, he remained president of the investment trust until his death.

Animoca Brands, Kraken, Paxos, what else? Jacob Rothschild's journey in crypto

It was Lord Rothschild under whose leadership RIT Capital Partners started heavily investing in cryptocurrency and blockchain start-ups.

For the first time, the global crypto community started discussing this trend in 2016 when the Rothschild family decided to drop the U.S. dollar for "other currencies." Some enthusiasts hinted that Bitcoin (BTC) could be a safe haven for legendary investors.

However, the first confirmed investments in the crypto segment were announced in 2021. The Rothschild-founded VC unit co-led an $8.8 million round for HK-based blockchain platform Aspen Digital.

Besides Aspen Digital, he also invested in GameFi pioneers Animoca Brands, creators of leading Web3 game The Sandbox (SAND), top-tier centralized crypto exchange ecosystem Kraken and Dapper Labs, the NFT heavyweight behind CryptoKitties, NBA Top Shot and Flow (FLOW) L1 blockchain for digital collectibles.

RIT witnessed major portfolio shift in 2022 amid crypto collapse

Despite the exact sum of investments never being disclosed, U.K.-headquartered Rothschild Trust was said to be investing 2-3% of its portfolio into blockchain-related products.

Among others, RIT Capital Partners backed funding rounds for Paxos Global, a Web3 platform behind USDP and other centralized stablecoins.

According to its 2022 report, the $4.6 billion investment trust marked down its stakes in cryptocurrency protocols by half following the collapse caused by the FTX/Alameda drama.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin