Ethereum, the second-largest cryptocurrency, experienced a major rally on Saturday, soaring by more than 15%.

The cryptocurrency climbed to as high as $1,422, the highest level since June 13.

Roughly $196.72 million worth of Ethereum short positions has been liquidated over the past 24 hours due to the big price surge, Coinglass data shows.

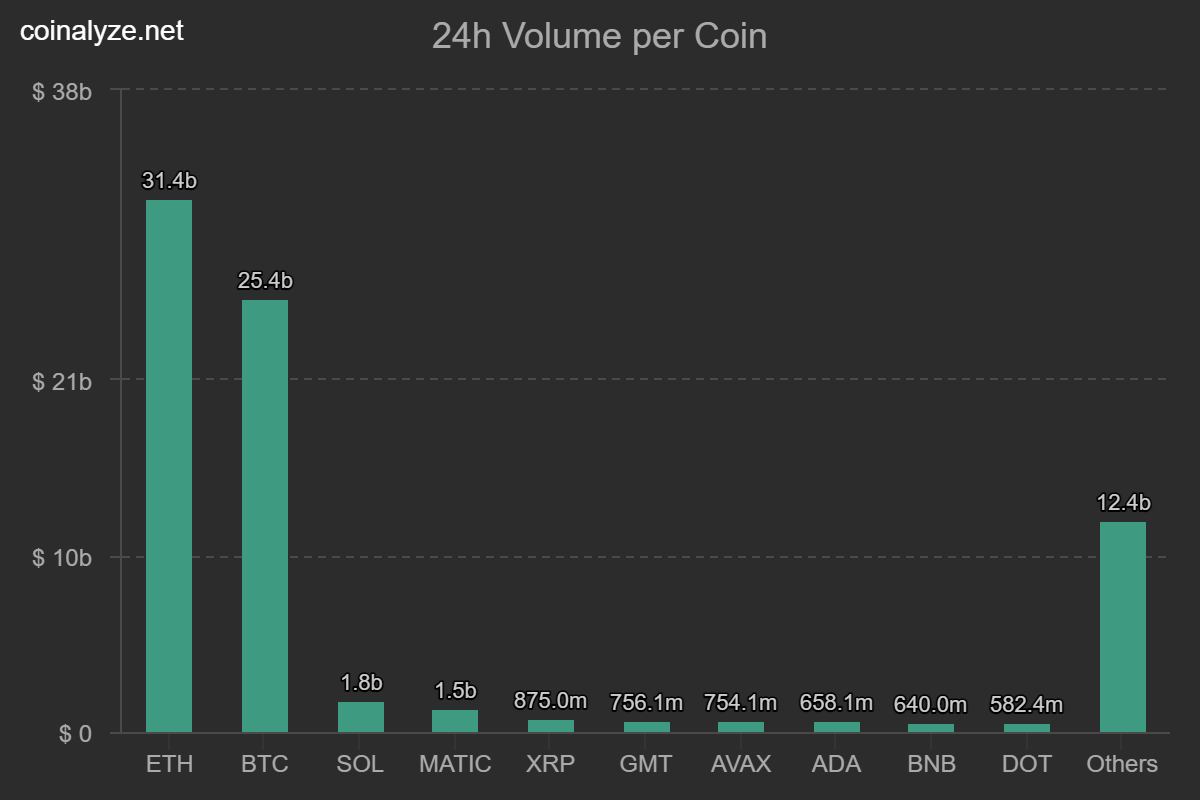

According to data provided by Coinalyze, Ethereum topped Bitcoin in terms of trading volume on futures markets on Saturday.

Ethereum managed to gain as much as 12% against Bitcoin on July 16, with the ETH/BTC pair touching the highest level since late May.

Earlier this week, Tim Beiko, one of the top figures in the Ethereum Foundation, recently announced that the much-awaited Ethereum upgrade would take place in September.

However, the timeline is still not final, meaning that the merge is still going to be postponed.

The Beacon Chain, the proof-of-stake version of the Ethereum blockchain, was rolled out in December 2020.

After Ropsten and Sepolia, Goerli will be the last testnet that will undergo the transition. This event is expected to occur in August, which will be the final step before the much-anticipated merge.

Ethereum’s proof-of-stake transition has long been viewed as the main bullish catalyst for the second-largest cryptocurrency this year, which is why the most recent price spike was predictable.

Still, Ethereum is down more than 72% from its record high of $4,878, which means that the largest cryptocurrency would have to gain a lot of ground in order to reclaim its historic peak.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov