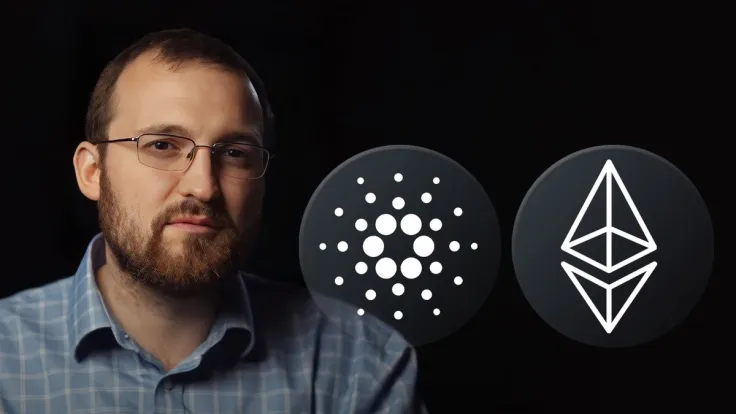

Blockchain developer and founder of Cardano Charles Hoskinson has shared a fresh take on the subject of his chief brainchild, this time in terms of staking.

Comparing it to Ethereum (ETH) as the largest proof-of-stake blockchain by capitalization, Hoskinson notes a specialty of Cardano that, in his view, lies in the number of unique addresses involved in the staking process. The chart provided by Hoskinson shows that the number of unique staking participants' wallets on Cardano equals more than 1.2 million. Meanwhile, Ethereum (ETH) has 88,400.

It is as if a lot of people decided to build an excellent staking protocol years ago and achieved it, says a blockchain developer.

Hoskinson's figures are partially confirmed by a Staking Rewards portal. According to the data, Cardano's staking ratio is 68.11%, while Ethereum's is 15.6%. That means that the number of outstanding ADA delegated to staking is almost 4.4 times higher than for ETH.

However, because of the price difference between Cardano and Ethereum tokens, the latter has a market staking capitalization 3.5 times larger at $34.29 billion.

Also, according to the website, Ethereum has a higher staking reward than Cardano, 4.92% versus 3.24%. If we take into account the adjusted reward metric, which considers the annual reward rate adjusted for network supply inflation, the gap is even larger, at 5.13% versus 0.17%.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin