Do you have to pay tax on cryptocurrency? How does the government calculate taxes on cryptocurrency? Does day trading incur taxes on cryptocurrency? Many people have varying opinions when it comes to the management of cryptocurrency assets. The astronomical performance since the emergence of crypto and Blockchain technology has caused a paradigm shift in the financial market.

Now, investors are faced with the challenge of how they can file their taxes. It will help to study how cryptocurrencies are categorized. Are your digital assets considered as traditional currencies or assets like stocks or bonds? Let’s find out.

How does the IRS treat cryptocurrency?

When it comes to taxes and cryptocurrency, the IRS considers your digital asset as a property. What is the implication of this? This means that cryptocurrencies are treated like gold, real estate or other raw materials. For this reason, the rules which apply to transacting these properties also apply to cryptocurrency.

To understand the gravity of the situation, the IRS recently released a statement on how they tax cryptocurrency. This statement clearly answers the question, “Do you have to pay taxes on cryptocurrency?” According to the release, if anyone is pronounced guilty of tax evasion, such an individual could face up to five years in prison and/or a fine of $250,000.

This also means that you’ll be required to report gains and transactions, although you must meet a certain threshold before you can get access to some of these reports. To give you an idea, Coinbase will only provide you with a statement similar to the 1099 tax form if you’ve realized $20,000 in profit or you’ve completed 200 transactions.

What do you need to submit to the IRS?

1. Information on when you bought the cryptocurrency

2. How much you paid for the cryptocurrency (in USD or its equivalent)

3. When you sold the asset

4. What you received on the sale.

Breaking down cryptocurrency tax

It is worth noting that only your gains on cryptocurrency are taxed. If you buy, hold or transfer cryptocurrency, these events are not seen as taxable and you are absolved of any tax evasion charge. Also, if you receive cryptocurrency as a gift, you are exempt from tax, however, if the value of this gift exceeds that of the stipulated Gift Tax, you are required to file for taxes.

How to pay taxes on cryptocurrency gains

Now that trading cryptocurrency is fast becoming a norm, just like stock trading, certain rules apply. As earlier mentioned, your cryptocurrency is considered a stock and it is taxed as such. Hence, if you purchase one Bitcoin for $6,000 and then it appreciates in value to $6,200, and you trade this Bitcoin for $6,200 worth of Ethereum, the profit is now taxable.

“But I didn’t get any cash!” Well, that’s not what the IRS considers. This is why it’s important to keep a record of your transactions because if you do not, the IRS is permitted to charge you a ridiculously high rate. You will need to calculate the cost basis of your holdings to know how much you should pay.

How is the cost basis determined?

Your cost basis includes the purchase price, the transaction fees, commissions (if applicable), and other costs. Based on this rationale, the cost basis is calculated as the

Price of Purchase + Transaction Fees + Commissions + Miscellaneous Quantity of Holding

Hence, to see if you incurred a loss or made a profit, simply calculate the Sale Price using this formula,

GainLoss= Sale Price-Cost basis

Taxes on short-term capital gains

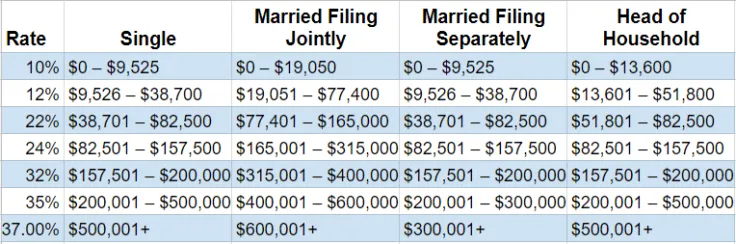

Short-term capital gains is a common source of tax and this is becoming increasingly prevalent in recent years. Short-term capital gains occur when a cryptocurrency asset which you hold for less than a year and then sell brings in profit. How do you report taxes on cryptocurrency gains? The tax is calculated at your marginal tax rate and it depends on your status. Below is a table detailing the marginal tax brackets for 2018.

Here’s an illustration of how to pay taxes on cryptocurrency gains.

As an individual, Mr. K. made $60,000 in 2017. However, in that year, he traded during the Bitcoin bubble, bought Bitcoin for $1000 and sold it for $9,000. This increases Mr. K’s earning to $68,000. The marginal rate then applies to the earnings, and 22 percent is taken.

How to reduce your cryptocurrency tax

1. Invest in crypto for the long run

Short-term cryptocurrency gains incur the highest tax. Try to hold for over a year and see the drastic tax reduction you enjoy on your profits. In a way, we can say the patient dog eats the fattest bone. Long-term thinking does not only being reduced taxes, but it also helps you earn more on your crypto investments. Remember that these assets are highly volatile and irrational fluctuations can deceive you.

2. Avoid the urge to convert crypto profits to crypto purchase

Your tax bracket and the duration of holding the cryptocurrency plays a huge part when talking about the amount paid in tax. If you realize a significant return on your sale, it is advisable to keep the money as a conventional currency rather than investing in another hot cryptocurrency.

3. Document all your crypto transactions

If it is possible, hire a virtual assistant to open a spreadsheet where you can input and see the transactions as they are being completed. This is especially needed when you are using various exchanges or when you transact volumes. Failure to report this completely might be seen as tax fraud and you don’t want that, do you?

4. Hire a qualified tax attorney

Do you own back taxes? There’s no need to be scared. Just play it safe and cautious, the safest thing you can do is to hire a lawyer who will help you file and ensure that you don’t go to jail.

Conclusion

It is more important to apply the strategies learned and utilize them to properly file your taxes and avoid heavy fines or jail sentences. Also, it was reported that only about 802 people reported their cryptocurrency profits and earnings to the IRS, don’t be among the majority of people who will be punished.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin