Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

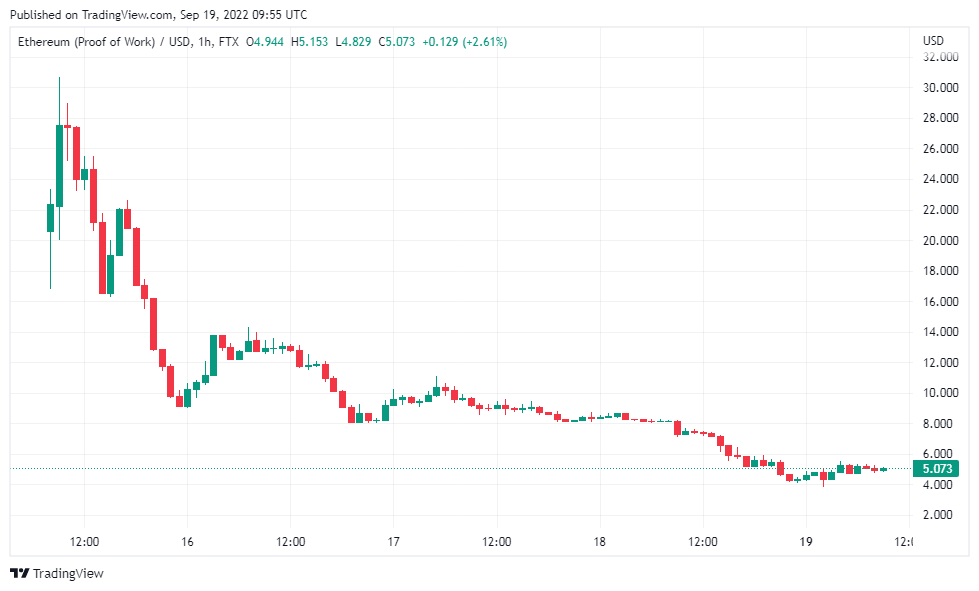

In the four days since Ethereum switched to the proof-of-stake consensus, Ethereum and all of its forks have fallen significantly. If ETH itself fell by more than 25%, ETC and ETHW showed even worse dynamics. Ethereum Classic was declining faster day by day and finished the week 3% lower than the main altcoin, while the fresh fork, ETHW, lost almost 80% in value in just four days.

The fall of all Ethereum cryptocurrencies was forecasted by many when the first day after the event followed the sell-off of the altcoin and the rise of Bitcoin's dominance. The situation was exacerbated by the simultaneous release of a number of negative news reports describing both the SEC's harsh plans, represented by its head Gary Gensler, for PoS cryptocurrencies, and the fact that 40% of all Ethereum PoS nodes are controlled by only two entities after the Merge.

Failed forks

It seemed that Ethereum Classic, which was growing by 230% on the eve of the Merge, had a chance to survive if all the miners, left without ETH, switched to ETC. Nevertheless, as it turned out, no one needs ETC either, as Cardano founder Charles Hoskinson stated, and moreover, according to WhatToMine, its mining is unprofitable at the moment.

As for Ethereum proof of work, in addition to the fact that one of the largest fund managers Grayscale announced at the end of the week the sale of 3 million ETHW, its chances of success were initially close to zero due to the unprofessionalism of the team, as a prominent blockchain developer said.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov