Recently, I spoke with Dan Thomson, CMO at InsurAce Protocol, about protecting people’s investment funds against various risks. He told me what risks they cover and shared the company’s greatest achievements and plans. We also discussed the $INSUR token and some personal things about Dan. Don’t miss this piece!

U.Today: I saw on your LinkedIn profile that you have had a long career managing bars and restaurants. What led you into the crypto field?

Dan Thomson: Yes, my background is a mixture of hospitality and finance. I always kind of bounced around between the two. I set up my own bars and restaurants. I left home when I was very young, around 17, and I fell into the world of coffee shops, pubs, bars and restaurants—as my first side work—and then ended up opening up my own bars from the age of around 21 to put myself through university. From then, it was a mixture of financial jobs and other hospitality businesses. I set up a chain of juice bars in the U.K. In 2015, one of them was based out of Old Street in London, which they call “Silicon roundabout”, in other terms, it is London's version of Silicon Valley.

It was in 2015 that I first came across Bitcoin. This was because we were having problems with traditional finance and our payment solutions for the hospitality business. We were being charged 3% on card fees and paying monthly retainers for the machines, locked into five-year contracts, which obviously wasn't great. I was discussing cryptocurrency with someone because there was a new Bitcoin machine, which was all very exciting, and that basically got me into Bitcoin at an earlyish stage. I was very lucky to buy some Bitcoin then, and I kept a vague interest in the space over the next couple of years. In 2017, I was living in Gibraltar, South of Spain. From there, they started developing a DLT legal framework. With a few other individuals, we then set up Europe's first private index fund based out of Gibraltar, which was all pretty exciting. This was on the side while still running the restaurants and bars. It was a great business to migrate over into crypto with.

Then, the pandemic came around and closed all of the hospitality bars and restaurants around, unfortunately, that includes the other businesses I had. That actually freed me up to do two things. First of all, I moved into crypto full-time, which has been great so far. I found a job with and joined the team at InsurAce, and this also freed me up to travel—not what a lot of people had the opportunity to do once the pandemic came around. But I changed my life up and became one of those digital nomads. I've spent the last couple of years just traveling the world, working remotely and focusing on crypto full-time.

U.Today: Tell us about your position at InsurAce protocol. What's your role there?

Dan Thomson: Sure. I wear many hats, which is true, I guess, with anyone in start-ups. My official title is CMO, chief marketing officer, but I also head up business development. It is quite a diverse role: everything from heading up the marketing team, making sure social media and various forms of marketing and advertising go out, and developing our growth in general.

Business development can be as broad as onboarding new partners, focusing on getting listed on different exchanges, working out different types of partnerships and integrations, and a hefty amount of product design—developing new insurance products and developing improvements to our website and UI with the team. We have a great team based out of Singapore, and it is nice to work with them to constantly improve what we do.

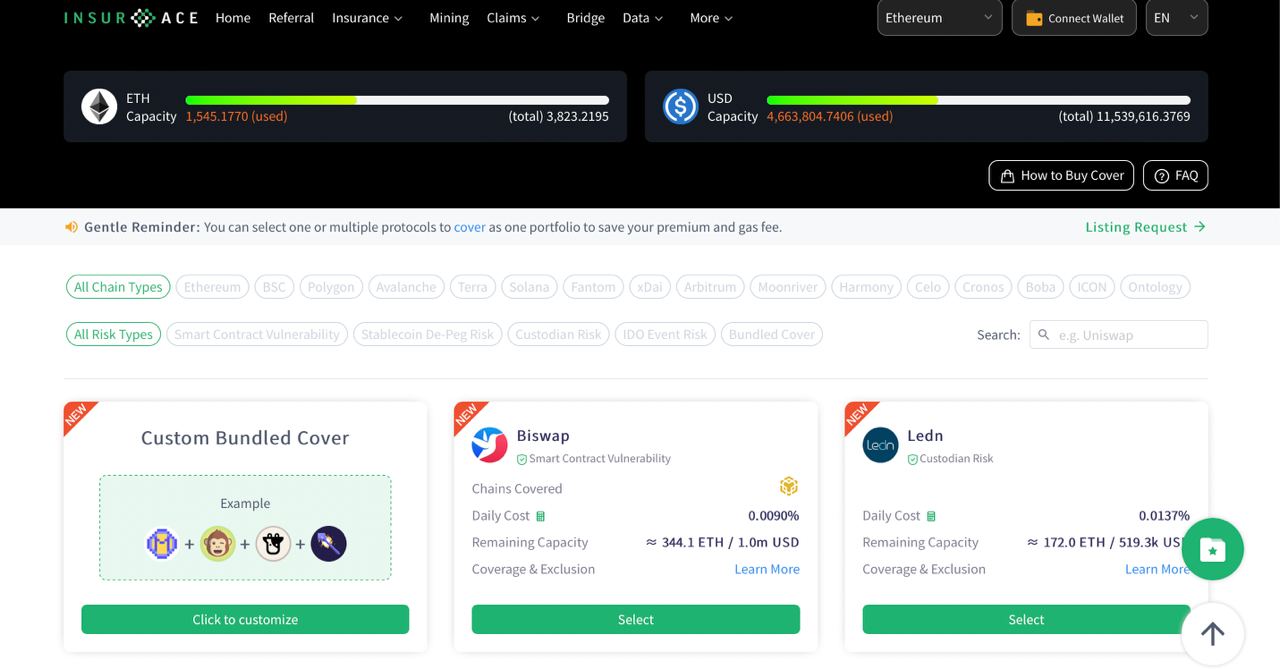

U.Today: InsurAce is a multi-chain insurance protocol that provides services to DeFi users, allowing them to protect their investment funds against various risks. Can you give us more details about it? What kinds of risks does it cover?

Dan Thomson: As a DeFi insurance protocol, we basically protect DeFi investors and users to try and make crypto safer for them and everyone involved. We are protecting them against hackers, smart contract vulnerabilities and any other bugs in various pieces of code. If you look at DeFi as it stands today, you're looking at an industry that has a couple trillion dollars of the crypto market, with about $250 billion worth of funds locked into DeFi at the moment, and less than 2% of that is actually insured right now. This is where we're trying to help make this all a lot safer. You look at the previous year of DeFi and there's been over $3 billion worth of hacks. It's not slowing down, it's up from about $120 million in 2020. We protect users against that.

Say you've got $10,000 locked into a particular protocol. It could be Anchor or Terra, or Beefy Finance or Olympus DAO. You are getting quite good returns on your investment there—20, 30, 40 or more percent. For just 2-3%, we basically protect your assets against any possible attacks or exploits or bugs on those funds. We protect users against any losses.

We do this across four different chains. We're built onto Ethereum, Binance, Polygon and Avalanche, but we actually cover 17 different public chains. That makes us the most widespread insurance protocol covering, I think, over 107 different protocols as of now. This has grown from nothing in the last nine months. We're growing at a very quick pace. We actually are the fastest-growing insurance protocol out there with an average of 60% month-to-month growth.

U.Today: How does InsurAce work? Let's imagine I'm a normal user, and I know nothing about the crypto field. What should I do to get help from you guys?

Dan Thomson: Our company is a bit deeper down the crypto rabbit hole than for someone who is just getting started in crypto. We work in DeFi. We're talking about people who have already bought and invested in tokens, who have started to explore how to make higher returns out of their crypto portfolio. You're looking at people who are staking assets on different protocols. It's a bit more on the advanced side of DeFi and crypto than the average starting user. You take your initial crypto and stake it into a different protocol. For instance, you might take USDT, which is Anchor’s stablecoin pegged to the dollar, and you might want to lock it into Anchor protocol to get 20% APY returns. You can then come to us to insure it for 2.5%, so you're still making 17.5%, but your funds are protected against hacks, bugs, exploits.

The way it works is that we spread the risk between users. You pay your 2.5%, and that coverage is then spread between our premium pool and stakers in our protocol. So, the stakers in our protocol get quite high returns in return for sharing the risk with us. The reason they do that is because they understand that by staking with us, they're spreading their risk across four different chains, across 100+ different protocols. Thus, the chances of actually having a significant loss on those funds is quite low because it would take 10 different protocols to have a major exploit at full capacity and every single wallet that has bought coverage with us to get exploited and to claim.

The protection is there. We always make sure we've got enough funds locked into the protocol. We always have sufficient capital to pay out in the event of a claim. Say you had $10,000 in Anchor and you had $10,000 worth of coverage with us; if that money were to be stolen by a hacker, you'd come to our protocol, you'd make a claim, submit your evidence, and that would go to a decentralized governance model within our protocol that would allow a very fast decision on whether or not to pay out based on the evidence given.

U.Today: Can you tell us about the $INSUR token

Dan Thomson: Sure. $INSUR token had its IDO in March 2021, just ahead of our mainnet launch in April 2021. The $INSUR token has a hundred million total supply, with a lot of it allocated toward returns with underwriting mining—the staking I just mentioned. It has a utility currently of governance for our protocol. Holders of $INSUR can stake with us to vote on the different aspects of the governance. They use the token to vote on claims and other aspects of the business as well as earning rewards with $INSUR. It's a fairly standard governance token for now. But we have our V2 coming up, just around the corner - very soon—we hope within the next four to five weeks. That will add quite a lot of extra use cases to the $INSUR token, including holding $INSUR, giving you discounts on insurance, ability to pay with $INSUR, to buy insurance, buyback and burn incentives and reinsure—to basically borrow against the $INSUR tokens.

U.Today: What are InsurAce’s greatest achievements, in your opinion?

Dan Thomson: We're extremely transparent with our data. So you can see everything on our app: app.insurace.io. We've covered over $230 million worth of assets since our inception. Incredible really, In only nine short months, we've covered $230 million worth of assets. Today, we've sold over $1.3 million worth of coverage. We've listed 107 different protocols, and we've covered 17 different public chains. We've gone multi-chain, so we're actually deployed on four different chains, with three more in the works right now. We're deploying onto Near protocol very soon, as well as Harmony and Phantom. We've got more chains that we're deploying onto.

Our biggest achievements really are our stats: we're the fastest growing in the space. This is a super exciting time for us, and the momentum just doesn't stop. There's a lot of hype in crypto and DeFi, and we're one of the few out there that has genuine use, actual revenue and a sustainable business model.

U.Today: What are InsurAce’s plans for this year?

Dan Thomson: As I said, this year is super exciting. It really will be the year of insurance for DeFi. We're already getting bigger and bigger requests for insurance from institutions, individuals, funds. For us, the big thing right now is our V2. So that updates our branding, it updates our entire tokenomics, our entire white paper and protocol functionality. We have learned a lot in the last nine to ten months, and that all gets implemented at the end of March. It's a big change that will improve tokenomics, allowing for a positive impact on our price for our token holders, and it will allow us to grow and expand our coverage to sell more insurance. We're going to be aggregating cross-chain on our protocol, which means that we'll be able to share the capacity we have on each different chain with each other. That will expand our coverage quite significantly. We're going to add reinsurance options. That will also increase our capacity, and all of this helps us to sell more insurance, which in the long term benefits not only us but also our holders and our community.

U.Today: Now, I also have several personal questions if you don't mind answering them. Tell us about your favorite crypto projects and the most influential leaders in the space, in your view.

Dan Thomson: My favorite crypto projects at the moment are pretty much all that are trying to build on Cosmos. Cosmos as an ecosystem is an incredible concept. It is the Internet of Things for crypto. It is trying to be everything for everyone in crypto. I went to the Cosmoverse conference in November last year, and the brain power working on Cosmos now is absolutely insane. However, the problems that they're trying to solve, I don’t think, are real problems, or they may not be real problems for a very long time. Do I think it will achieve what it is setting out to do? I'm not entirely sure. I think it might fizzle out before then, but in terms of my favorite projects, as a passionate participant in this sphere and on an intellectual level, anything being developed on Cosmos is incredible.

In terms of influential leaders, there's a few good ones out there. Part of my job is to work with influencers and media, and everyone who reads Crypto Twitter knows that a lot of people will just say anything right now and delete the things that went wrong and keep the ones that went well, to always be right. My favorite guys are some of the deeper DeFi influencers. I'm really enjoying some of the NFT things by people like Santiago Santos, who's mostly based on Twitter. On YouTube, I think Coin Bureau does a fantastic job of getting people into the space and understanding the basics at a very simple level, as well as their Telegram newsletter, which is fantastic for a quick snapshot of the news. It's a lot less biased than some of the media that is covering this space. I've got a few favorites that I like to follow.

U.Today: Do you have a crypto portfolio? If so, what's in there, if it's not a secret?

Dan Thomson: It is mostly secret, but I'll give you some good ones. I still have my holdings of Bitcoin from 2015, which is wonderful. I did very well not to sell it and, even more importantly, not to lose my private keys in that time. That's done very well over the last seven years, as you can imagine. Otherwise, I keep a steady portfolio of ecosystems, mostly. My biggest holdings are everything from Ethereum, Solana, Terra, Atom—from Cosmos again, for a bit of faith—even some Binance and Phantom. Phantom's a big one for me this year. Phantom projects are probably some of the biggest things I've invested in lately. I've been getting into quite a lot of different projects on Phantom over the last couple of months, so Phantom is a big one for me this year.

U.Today: My last question is: What will the Bitcoin price be in the near future? Let's say, half a year or a year from now?

Dan Thomson: That is the golden question. I'll give you a guess, let's say in half a year. That would be June-July, summertime. I'd say we're probably going to be back up around the all-time highs in half a year.

By the end of the year, I think we might have a bit of a dropdown, but I don't think it will be because of any crypto fundamentals. I think this is because of the wider market sentiment right now. You're looking at a global economy that's had a lot of struggles due to the pandemic. Some of that is starting to show: you've got high inflation in Europe and high inflation in the U.S. I think that's going to have a serious negative effect at some point. I don’t know when; I’m not an economist. But you can see it everywhere you go.

I'm very privileged to be able to travel a lot, and all the places I go, you see inflationary pressure. I'm back in the U.S. right now, and the levels of fear and hate —not just on the markets, but even with individuals, and the actual prices of things have increased so much in the last couple of years that it has put a lot of pressure on a lot of people. The last time rates were at these levels, big recessions started. I think that that will drag the crypto market down to some extent, but at the same time, my scope of crypto is a matter of five years, rather than six months or a year. I think the recovery will be a lot faster than the wider market. But I think they will drop together.

U.Today: Thank you, Dan. It was very interesting to talk with you. Thank you.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin