Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Chris Burniske, a former Ark Invest analyst, recently took to Twitter to share his insights on the blazing crypto market. Known for his astute market analysis, Burniske cautioned that the current bullish trajectory of the crypto market might not maintain its heated pace. He mentioned, "The very beginning — but there will be periods of cool ahead, it doesn't stay white hot like this for more than a few months max — skip on."

Burniske's tweet signifies that while the market is at the beginning of a robust phase, it is unrealistic to expect the momentum to remain at this peak. Historically, markets, whether crypto or traditional, have their ups and downs. Periods of rapid growth are often followed by cooling off phases where the market consolidates before deciding its next direction.

Diving deeper into Burniske's thoughts, he categorizes prominent cryptocurrencies into two groups: "BTC and ETH the OG crypto barbell" and "SOL and TIA the integrated + modular barbell." This classification suggests that while Bitcoin (BTC) and Ethereum (ETH) remain the old guards of the crypto world, Solana (SOL) and TIA represent next-gen blockchain platforms that bring a blend of integrated and modular functionalities.

However, a second opinion on Burniske's thesis might argue that while BTC and ETH have proven their resilience and market appeal over time, it is premature to place newer entrants like SOL and TIA in the same bracket. These newer platforms, although promising, need to stand the tests of time, market volatility and regulatory challenges.

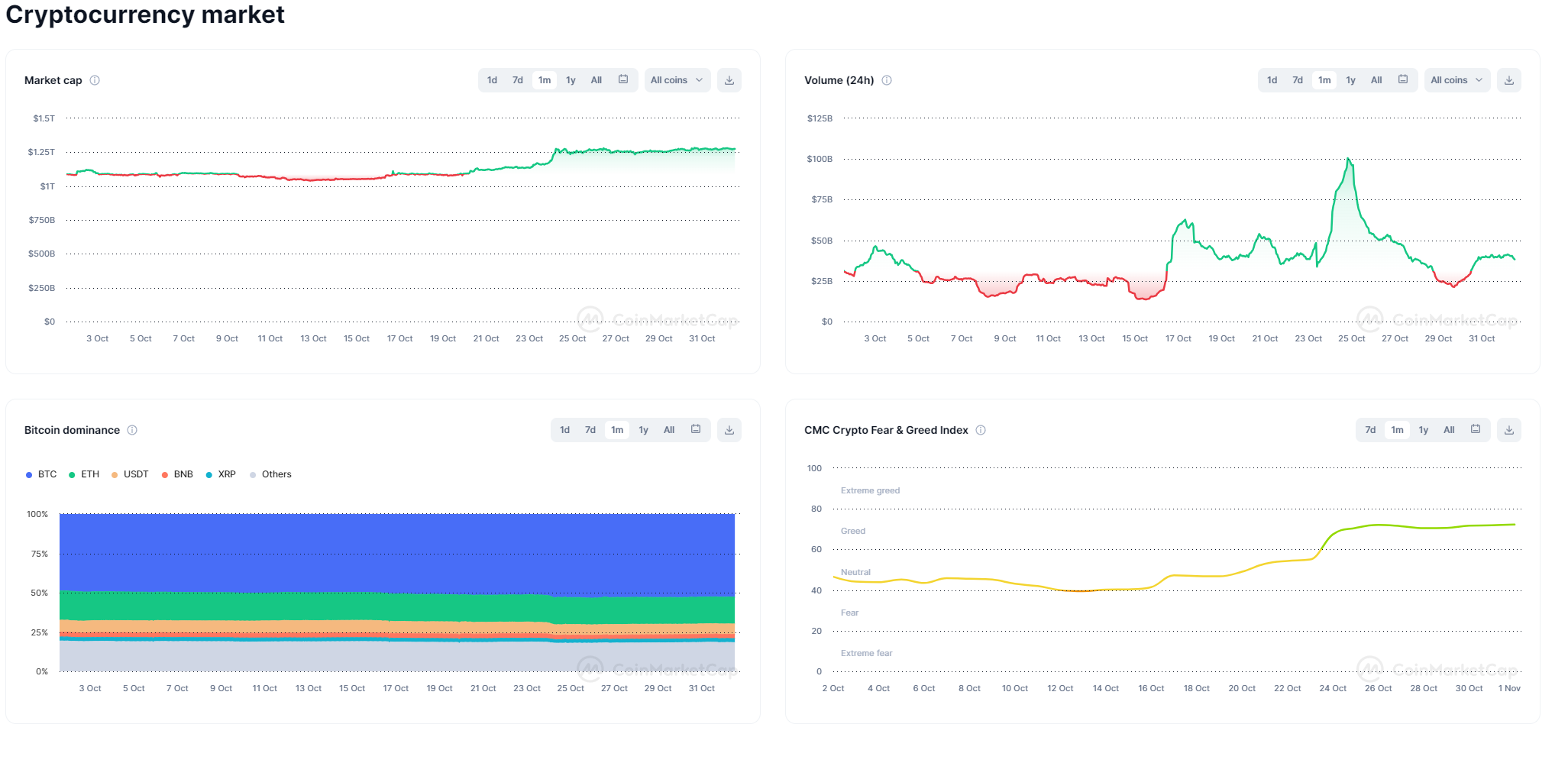

The crypto market chart further illustrates overall market sentiment. The market cap graph indicates sustained growth, hinting at bullish sentiment. However, the 24-hour volume graph showcases volatility with sharp peaks and troughs. The Bitcoin dominance chart reveals a steady share of BTC on the market, while the CMC Crypto Fear & Greed Index oscillates between "greed" and "neutral," indicating that while traders are optimistic, they remain cautious.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov