Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

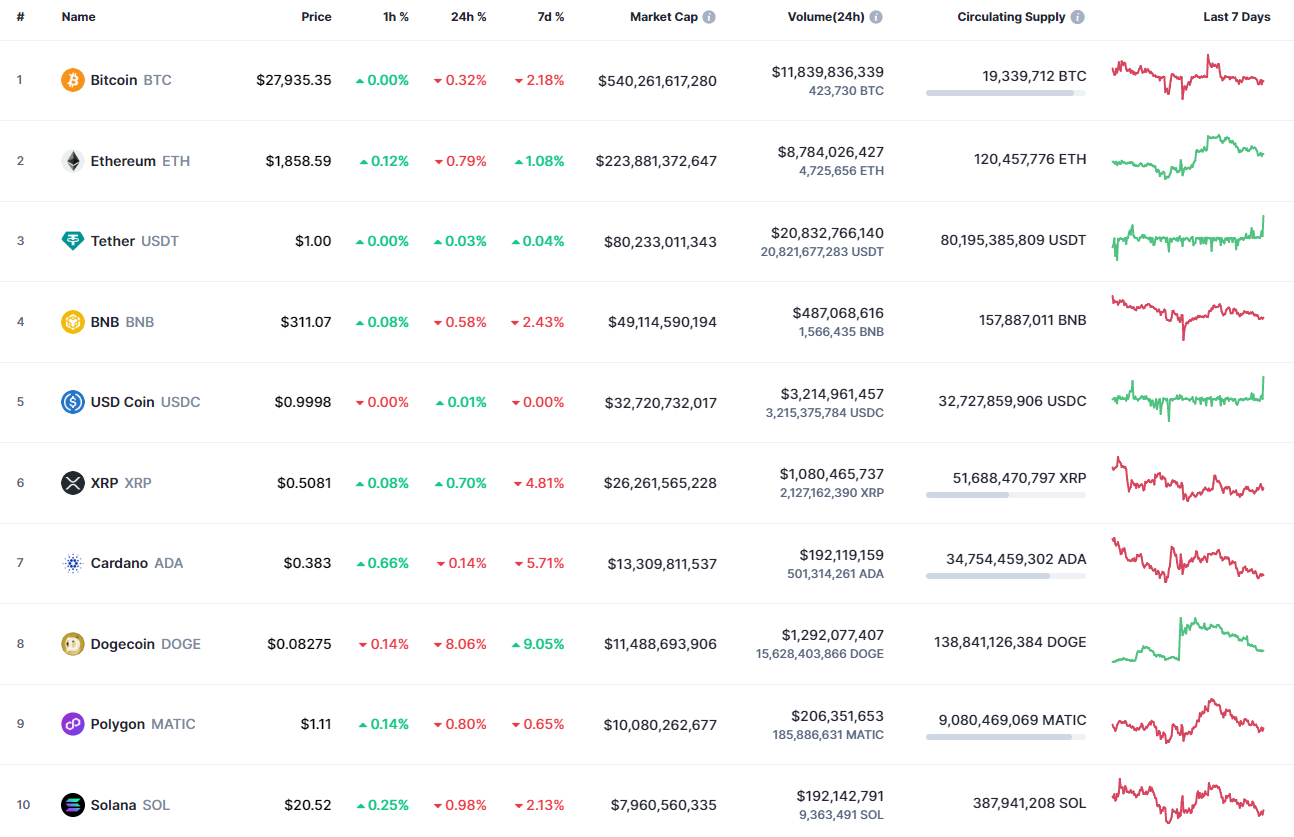

The last working day of the week is neither bullish nor bearish, according to the CoinMarketCap ranking.

BTC/USD

The rate of Bitcoin (BTC) has declined by 0.32% over the last 24 hours.

The volatility keeps declining as the price keeps trading sideways on the daily chart. Such a statement is also confirmed by the low volume, which confirms the fact that none of the sides has seized the initiative. In this case, ongoing consolidation in the range of $27,500-$28,500 is the more likely scenario for the next few days.

Bitcoin is trading at $27,968 at press time.

ETH/USD

Ethereum (ETH) is more of a loser than Bitcoin (BTC), falling by 0.79%.

On the daily chart of Ethereum (ETH), the price has come back to the bearish trend and is located below the resistance at $1,890. If buyers cannot seize the initiative shortly, the fall may continue to the $1,800-$1,850 area.

Ethereum is trading at $1,860 at press time.

XRP/USD

XRP is the biggest gainer from the list today, rising by 0.70%.

Despite a slight rise, the rate of XRP is far away from key levels. Further growth is possible only if bulls return the price to the $0.52 zone and fix above it. Until that happens, ongoing sideways trading in the area of $0.49-$0.50 is the more likely scenario.

XRP is trading at $0.50777 at press time.

DOGE/USD

The price of DOGE has continued its decline, going down by 8%.

Despite the ongoing decline, the rate of DOGE has not returned below the vital $0.08 zone, which means that bulls still control the situation on the market. Respectively, if buyers can keep the price above $0.08, there is a chance to see a bounce back to the $0.090 mark by the end of the month.

DOGE is trading at $0.0824 at press time.

ADA/USD

The rate of Cardano (ADA) Is almost unchanged since yesterday.

Today's slight fall of Cardano (ADA) has not affected its technical situation on the daily chart. At the moment, one should pay attention to the support level at $0.37. If the drop continues to it, the accumulated energy should be enough for a decrease to the $0.36 mark.

ADA is trading at $0.3836 at press time.

BNB/USD

Binance Coin (BNB) has followed the decline of Cardano (ADA), going down by 0.58%.

On the daily time frame, the price of Binance Coin (BNB) remains under sellers' pressure as the rate is located closer to the support than to the resistance. If a breakout of the interim level at $307.5 happens, there is a high probability of seeing the test of next important zone around $300.

BNB is trading at $311 at press time.

SOL/USD

The rate of Solana (SOL) has declined by 1.27% since yesterday.

The price of Solana (SOL) has continued its drop after a failed attempt to fix above the $21 zone. If buyers lose the next important area of $20, the decline may lead to the test of the support at $19.42 soon.

SOL is trading at $20.47 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov