According to its Q3 report dated Oct. 14, cryptocurrency asset management firm Grayscale had the largest quarterly inflows in history in the third quarter of 2020.

Its family of crypto funds has added a whopping $1.05 bln worth of investments, shattering the Q2 record of $905.8 mln.

Notably, offshore investors were responsible for 57 percent of the sum. Around 80 percent of all capital was brought in by institutions, with accredited individuals, family offices and retirement accounts the remaining sources of capital.

Grayscale's Litecoin Trust showed the best performance in Q3—a 1,800 percent increase in inflows on the quarter-over-quarter basis. It is followed by Grayscale Bitcoin Cash Trust with 1,500 percent.

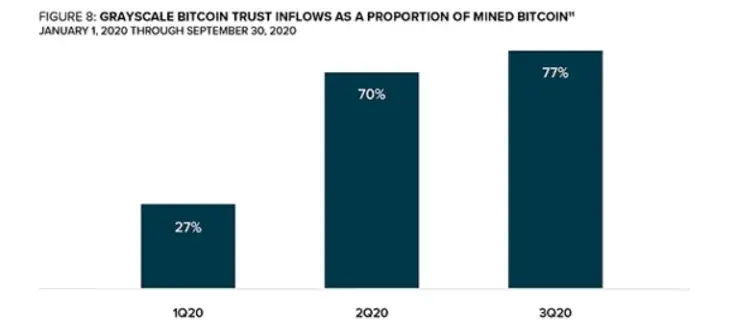

Meanwhile, Grayscale continued to absorb Bitcoin's supply at a faster clip. The company's Bitcoin trust attracted 77 percent of all Bitcoin mined in Q3 ($719.3 mln), a seven percent uptick compared to Q2.

Meanwhile, its Ethereum trust saw 17 percent of its inflows coming from new institutional investors.

Speaking of crypto tribalism, Grayscale's managing director, Michael Sonnenshein, claims that multiple assets can co-exist, comparing them to precious metals:

We believe in a future where multiple digital assets coexist. We often compare them to the likes of the precious metals family, where you look at something like gold, silver, platinum. They all exist amongst the precious metals family with different use cases and applications and prices.

Grayscale states that the cumulative year-to-date inflows into its suite of products has now totaled $2.4 bln.

The firm currency has $6.3 bln of digital assets under management, according to its Oct. 13 update.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin