The U.S. Federal Reserve has hiked the benchmark interest rate by 75 basis points following a two-day meeting held by its officials, continuing its aggressive monetary tightening.

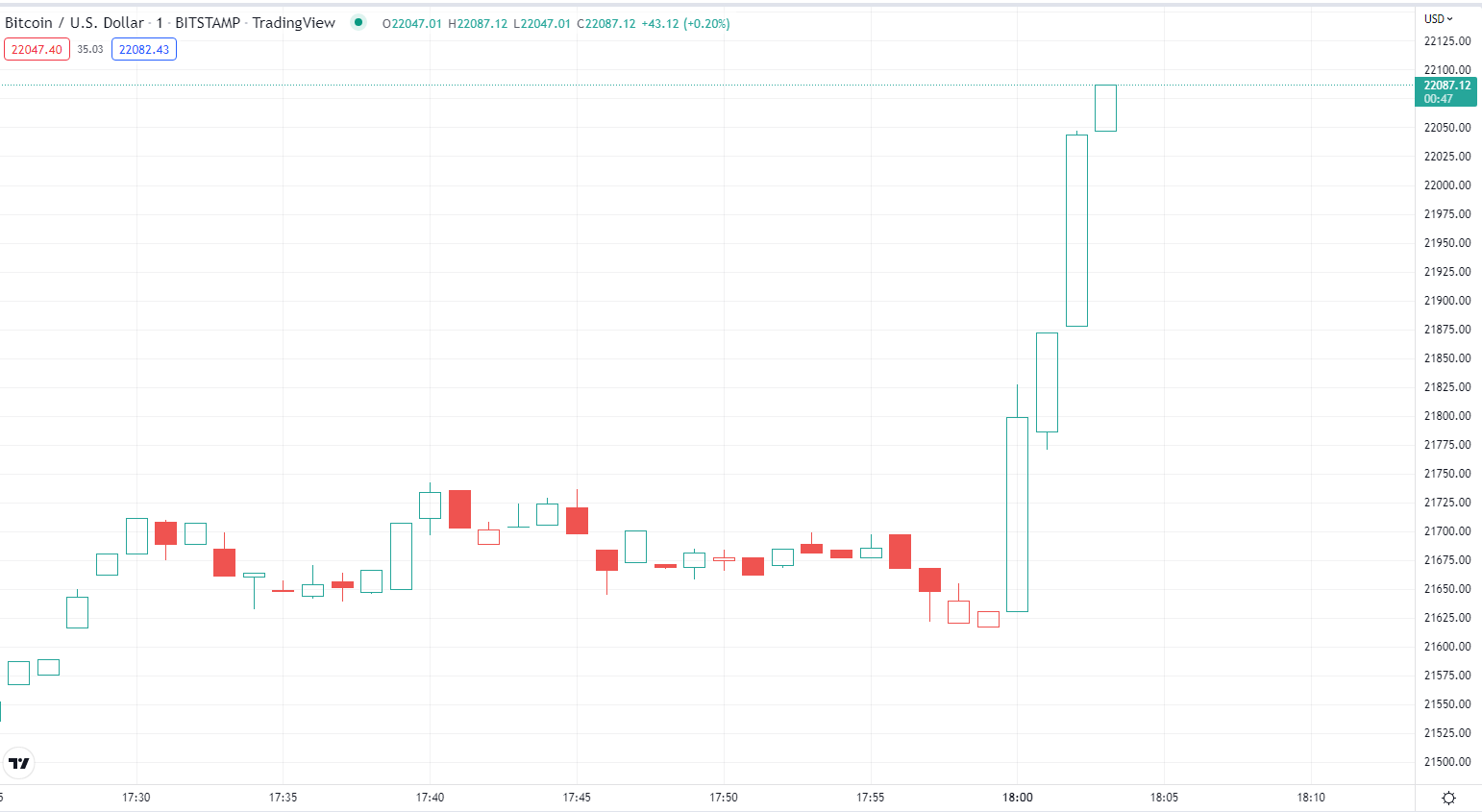

Bitcoin is currently up 3.07% and trading at $22,087 on the Bitstamp exchange, reaching a new intraday high. The price of the world’s largest cryptocurrency dropped by more than 14% in the run-up to the Wednesday event.

The world’s most powerful central bank has now brought rates to a range of 2.25%-2.5%.

As reported by U.Today, expectations for a 100 basis point hike rose sharply higher earlier this month due to highly elevated consumer price index (CPI) data.

It remains to be seen how far the Fed is willing to go in order to curb inflation. Further rate hikes will mostly depend on employment and inflation data.

The Fed is not alone in its hawkishness. Earlier this July, the Bank of Canada increased the policy interest rate by a whopping 100 basis points. Last week, the European Central Bank announced its first interest rate hike in 11 years last week in a surprising week.

Bitcoin, which has enjoyed low-interest rates throughout much of its existence, is struggling to navigate the new macro environment. While traditional assets, such as stocks and bonds, have been tested in various circumstances, it remains to be seen how the flagship cryptocurrency will respond to further interest rate hikes.

Bitcoin is currently down a whopping 68% from its record high of $21,674.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov