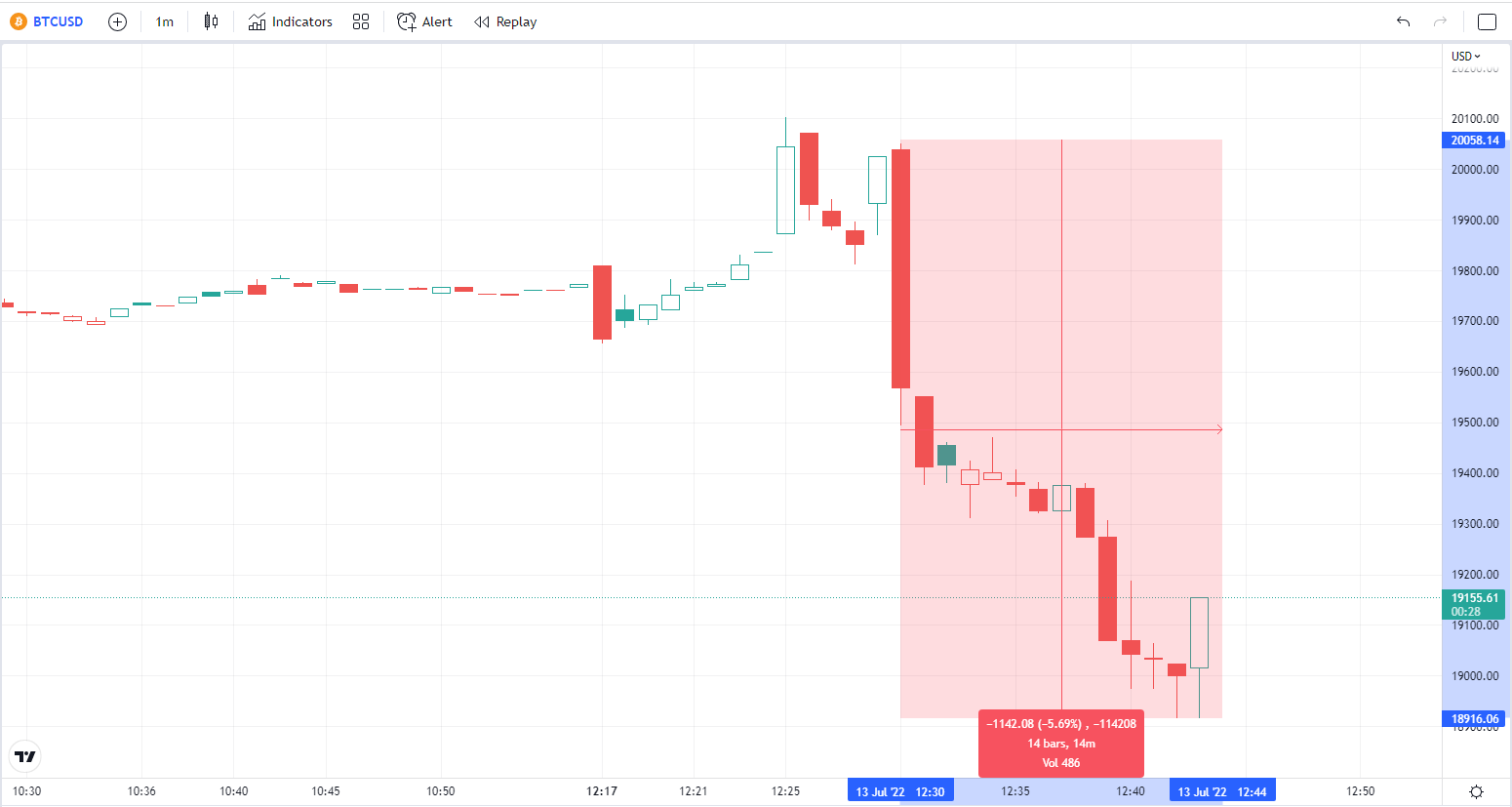

Bitcoin, the top cryptocurrency by market capitalization, has dropped to an intraday low of $18,916 on the Bitstmap exchange after the Labor Department reported that the consumer price index (CPI) had risen to a whopping 9.1%.

The world's largest cryptocurrency has so far shed more than 5% on the news, reaching the lowest level since July 4. The S&P 500 index also shed 1.6%.

Fresh 40-year high

The hotter-than-expected inflation reading will put even more pressure on the U.S. Federal Reserve to hike interest rates. On Monday, the BLS had to issue a statement after a fake CPI report made waves on social media and sent stock futures lower. The bogus leak showed that inflation skyrocketed to 10.2%, which is far above analysts' expectations. While the real CPI print is more than a percentage point level, it is still the highest level since November 1981.

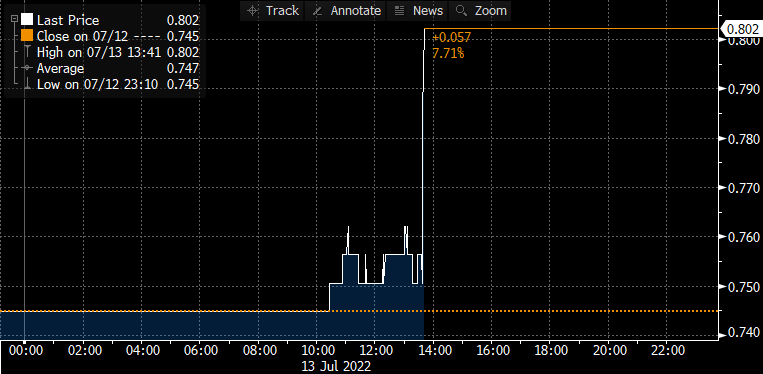

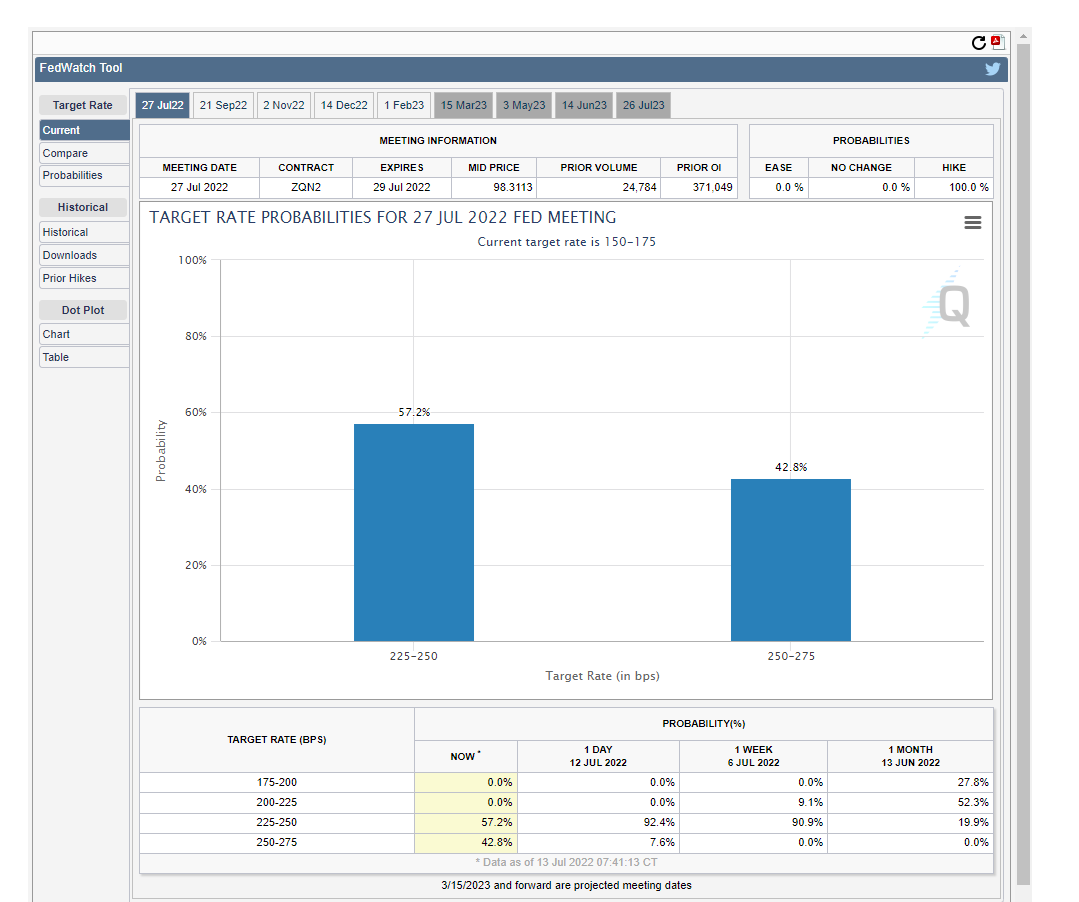

Fed Funds futures are now pricing at an 80 basis point interest rate increase following the CPI print. This, of course, will not bode well for cryptocurrency prices. The latest inflation print, which is above analysts' target of 8.8%, is highly likely to prompt the U.S. Federal Reserve to adopt a more hawkish monetary policy. This would deliver another big blow to speculation-driven investments like cryptocurrencies. Had the reading been below 8.8%, it would have given the markets a big boost. However, the Fed will not take its foot off the tightening pedal because of peaking inflation.

A 100 basis point hike is now on the table

It remains to be seen whether the U.S. central bank will opt for a gargantuan 100 basis point hike, which would be catastrophic for speculative investments. Presently, the swaps market is pricing on a 42% chance that the Fed will go that far in order to tame out-of-control inflation. The odds of a 100 basis point hike were at just 8% on July 12, the day before the most recent CPI print was announced.

Failing to perform as an inflation hedge, Bitcoin has tumbled together with other risk assets this year, plunging by almost 72%.

Bitcoin, which has been in a low-interest environment throughout its existence, has been pummeled by the Fed's monetary policy U-turn, together with other risk assets, which undermined the cryptocurrency's "inflation hedge" status. Strong jobs data that was published last week signaled that the Fed would be able to pull off a soft landing, thus avoiding a recession despite dramatically rising interest rates. The consensus among investors appears to be that Bitcoin is expected to face another sell-off after plunging as low as $17,600 in June.

A narrative problem

In March 2020, the Fed slashed interest rates by 100 basis points, bringing back the era of near-zero interest rates and quantitative easing pioneered by former Fed chair Ben Bernanke in 2008. The unprecedented effort to shore up the pandemic-hit U.S. economy led to the biggest cryptocurrency bull market to date. However, the bubble quickly popped after the central banked dialed back its support, bringing the era of free money to an end.

This, of course, creates a major problem for the Bitcoin narrative. Prominent analyst Jim Bianco recently opined that Bitcoiners secretly hope for more money printing and lower inflation so that their favorite cryptocurrency would rally together with stocks.

As reported by U.Today, Bitcoin's correlation with the Nasdaq 100 index is approaching a new record high.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov