A new day, a new round of inflows into BlackRock's Bitcoin ETF IBIT, and correspondingly new purchases by the hedge fund giant of cryptocurrency in its wallets.

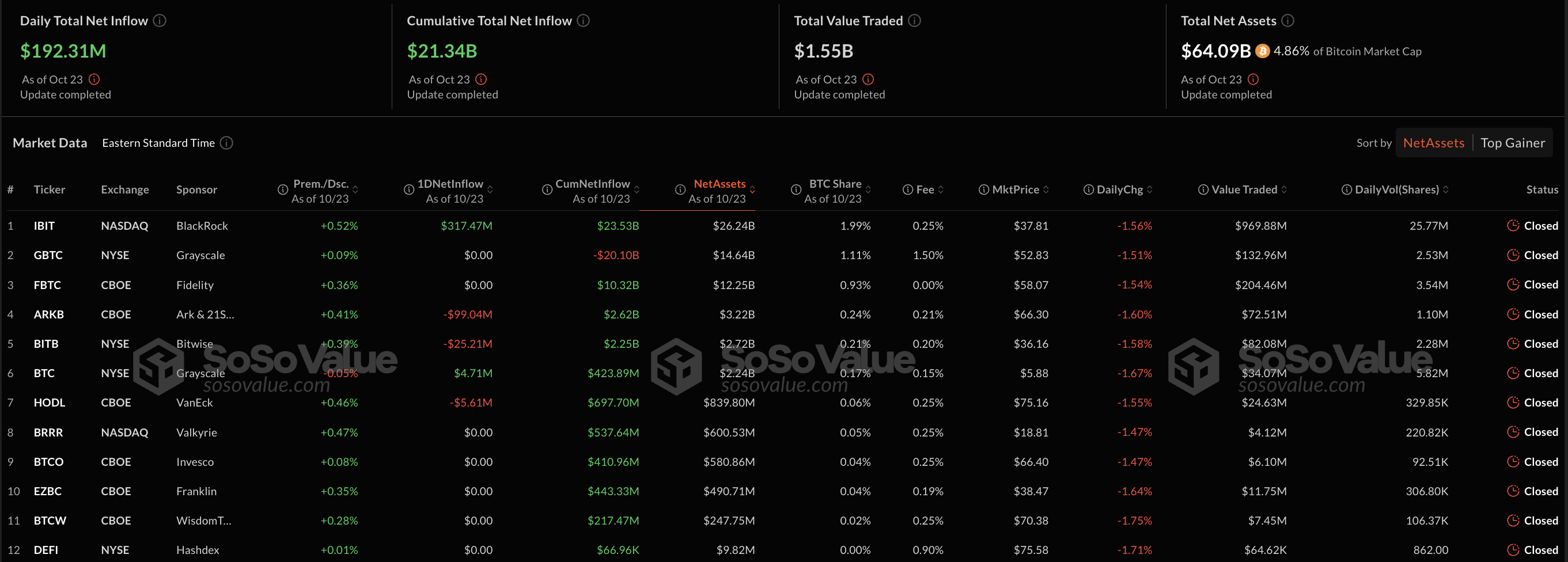

According to SoSo Value, the IBIT Bitcoin ETF has seen inflows of more than $317 million in the past 24 hours. By comparison, the day before, inflows into this instrument totaled $42.98 million, so we can literally say that inflows increased by a little over 737% in one day.

Inflows into ETFs directly from BlackRock have continued unabated for almost two weeks now. During this time, the amount of money raised by IBIT is already approaching a staggering $2 billion.

It is natural that such inflows into ETFs are accompanied by purchases of cryptocurrency from the issuer for the same amount.

BlackRock's Bitcoin

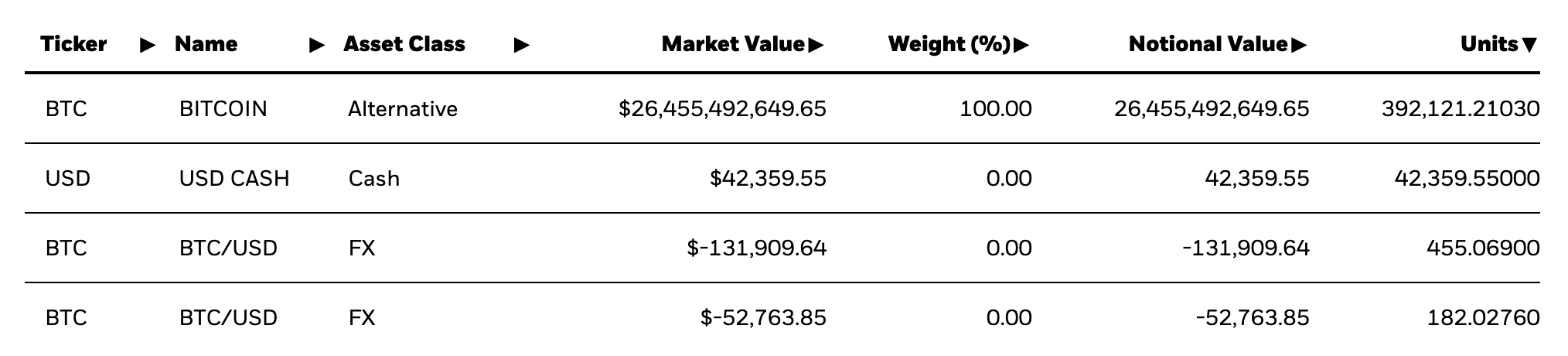

For instance, prior to today's $317 million net inflow data, it was known that BlackRock's iShares Bitcoin Trust ETF held 392,121,2103 BTC as collateral. At current prices, this is equivalent to approximately $26.27 billion. With the new inflows, it is clear that this amount will exceed $27 billion today if approximately 637 BTC are added.

As long as inflows into Bitcoin ETFs continue, we can expect BlackRock to continue to suck up the market. However, already one of the largest holders of cryptocurrency in general, it seems that the instrument is just an excuse, and the hedge fund's real interest is in owning Bitcoin itself.

Where BlackRock will stop in its crypto ambitions is the major question.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov