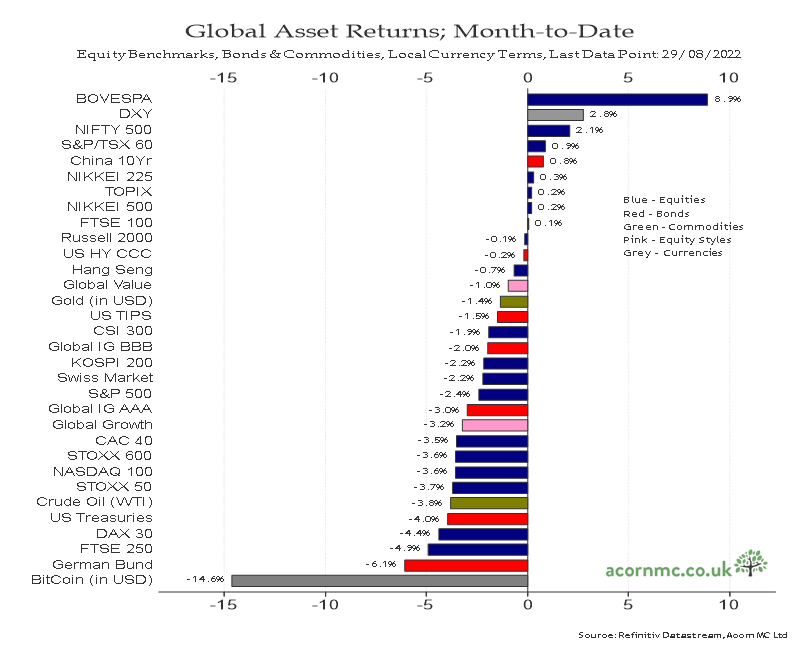

Bitcoin, the world's leading cryptocurrency, has had yet another underwhelming month, plunging by almost 15%.

According to data provided by U.K.-based Acorn Macro Consulting, it is the worst-performing global asset this August, sitting at the very bottom of the chart.

Brazil's Bovespa stock index is at the top of the chart after its furious August rally, adding nearly 9% over the past month.

The U.S. Dollar Index (DXY) continues to reign supreme. On Monday, the greenback clinched a new 2022 high of 109.5 after Federal Reserve Chairman Jerome Powell strengthened risk-off sentiment with his hawkish Jackson Hole speech on Friday. The DXY index, which measures the strength of the U.S. Dollar against other global fiat currencies, gained 2.8% in August.

The NIFTY 500, India's broad-based stock market index, has also added more than 2.1% this month.

Nikkei 225, the stock market index for the Tokyo Stock Exchange, is also in the green over the past month.

The S&P 500, one of the top U.S. stock market indices, is down 2.4% this month. The tech-heavy Nasdaq 100 index, whose performance is highly correlated with Bitcoin, has shed 3.6% in August.

The cryptocurrency recovered to $20,000 on Monday, but it then plunged below the key level yet again on Tuesday, struggling to regain any semblance of momentum.

It is currently changing hands at $19,942 on the Bitstamp exchange, and it is on track to log yet another day in the red.

After gaining 17% in July, Bitcoin surged as high as $25,121 in August, but this was then followed by a sharp decline.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov