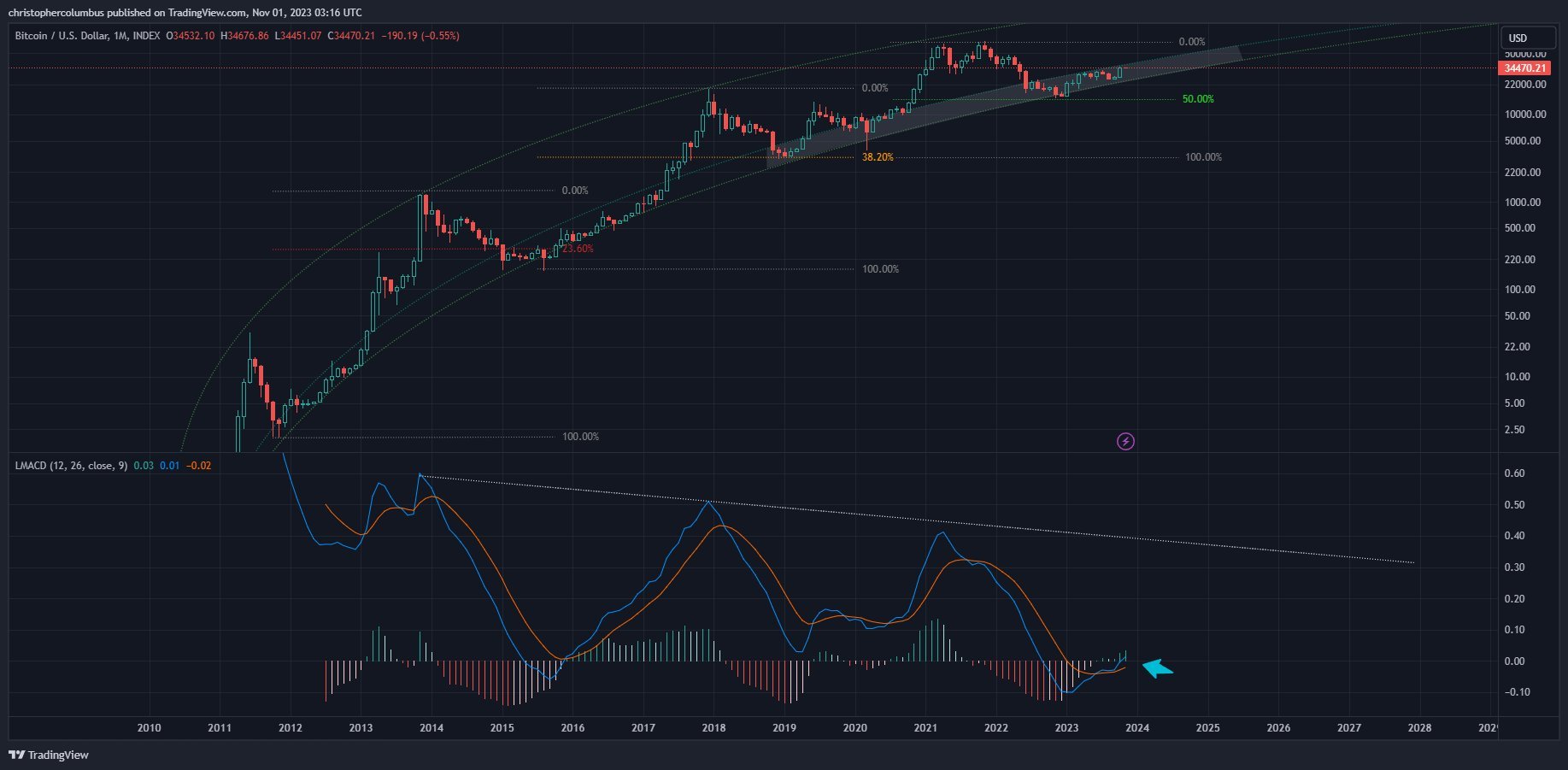

The Bitcoin monthly MACD (moving average convergence divergence) has crossed the zero line, signaling a potential entry into a bullish phase, according to recent analysis by prominent cryptocurrency trader Dave the Wave.

This movement has grabbed the attention of investors, enthusiasts, and analysts as the world's premier cryptocurrency, Bitcoin, stands at the cusp of a potential price rally.

A reliable indicator of price moves?

The MACD is a trend-following momentum indicator that showcases the relationship between two moving averages of an asset's price, typically the 12-day and 26-day exponential moving averages.

When the MACD moves above the zero line, it is generally interpreted as a bullish sign, suggesting that the asset's price might see an upward trajectory in the near future.

The recent chart depicts that Bitcoin's MACD has now shifted above this crucial threshold.

Such a move has historically preceded price rallies and is viewed as a positive sign by many technical analysts.

Recent bullish predictions

Recently, global asset management firm Bernstein expressed confidence in Bitcoin's potential price performance, projecting a surge to $150,000 by mid-2025.

Given Bitcoin's current trading price of $34,400, this would require an impressive 336% rise from its current position. The projection is grounded in the historical relationship between Bitcoin's price and its price-to-marginal cost. Past data suggests that Bitcoin's price seldom falls beneath its marginal cost, implying this metric could serve as a supportive "floor" for the cryptocurrency's value.

In other optimistic forecasts, crypto services provider Matrixport posited that Bitcoin could ascend to a range of $42,000 to $56,000 if BlackRock's ETF gets the green light. This prediction hinges on potential capital inflows nearing $24 billion.

Furthermore, banking giant Standard Chartered revised its end-2024 forecast for Bitcoin to $120,000, up from its earlier prediction of $100,000, highlighting increasing confidence in the crypto market's resilience and potential.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov