A recent projection by Bernstein suggests that Bitcoin, the flagship cryptocurrency, could soar to the $150,000 mark by mid-2025.

It is currently trading at $34,400, meaning that it would need to surge roughly 336% from where it is right now.

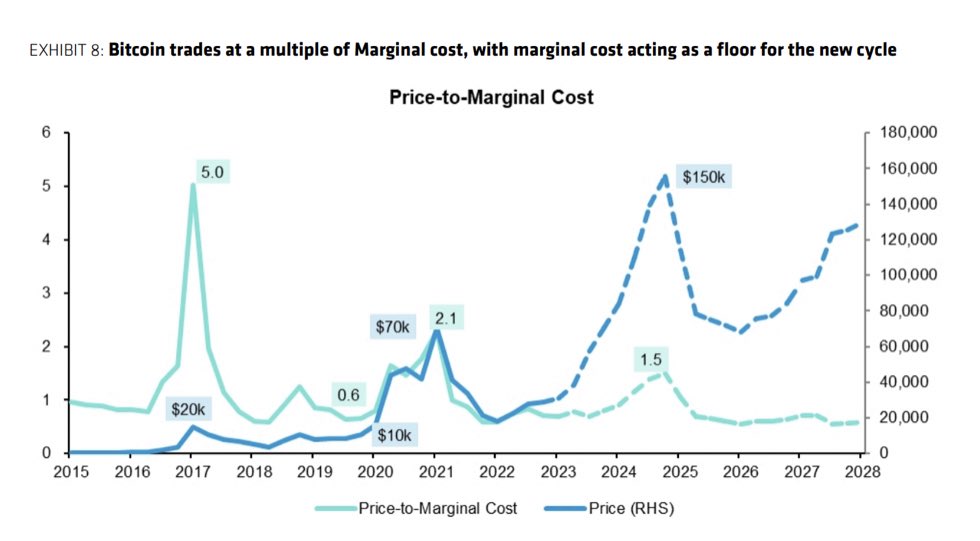

Bitcoin's price-to-margin cost

Bernstein's reveals the historical relationship between Bitcoin's price and its price-to-marginal cost. This metric is crucial as it illustrates how much Bitcoin trades above its production costs, providing insights into potential profitability for miners and the broader market sentiment.

In 2017, Bitcoin reached a 5.0 multiplier of its marginal cost, driving the price to an all-time high of approximately $20,000. A subsequent peak in 2019, albeit lower than the 2017 spike, saw the multiplier reach 2.1, correlating to a $70,000 price tag. The projection for the 2024-27 cycle indicates an anticipated price multiplier of 1.5, correlating with the aforementioned potential price of $150,000 by mid-2025.

The valleys in the chart further indicate that Bitcoin's price rarely drops below its marginal cost. This reinforces the notion of marginal cost acting as a support level or "floor."

For instance, in 2020 and 2021, the price hovered just above the marginal cost line, indicating periods of relative stability.

The ETF hype

As reported by U.Today, the research firm recently delved into the implications of a spot Bitcoin ETF approval in the U.S.

If given the nod, Bernstein anticipates that exchange-traded funds could account for up to 10% of Bitcoin's market value within three years. This is a significant factor, especially considering the Grayscale Bitcoin Trust already makes up approximately 4% of all Bitcoin holdings.

The firm has also recently positioned Bitcoin as a superior asset compared to gold, dubbing it a "faster horse."

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin