Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

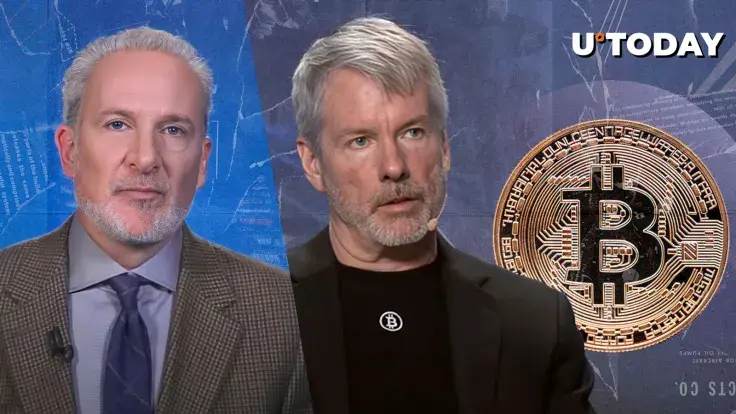

Peter Schiff has been one of Bitcoin’s loudest critics for years. And right now? He is doubling down on his prediction that Michael Saylor’s Bitcoin-heavy strategy is headed for disaster. With Bitcoin (BTC) dipping under $89,000, Schiff sees it as just another sign of trouble ahead - especially for Strategy, the company formerly known as MicroStrategy.

Schiff argues that Saylor's aggressive Bitcoin accumulation, funded by billions in convertible notes, is unsustainable. Right now, the company holds 499,096 BTC, with an average buy-in price of about $66,000.

That is roughly 40% higher than Bitcoin’s current price. And if Bitcoin does not recover? Schiff believes Strategy’s debt-fueled model will start to crack.

Real problem, according to Schiff

It is the company’s stock price. Strategy’s most recent convertible notes have a conversion price of $433.43.

If the stock remains below that level, the company may be forced to sell Bitcoin just to pay its creditors. That would create a downward spiral - Bitcoin selling pressure leading to further declines, dragging both the cryptocurrency and Strategy’s stock price even lower, argues the expert.

Schiff is skeptical of any potential recovery. He points out that if Strategy stock trades at a discount to its Bitcoin holdings, the company could theoretically sell Bitcoin to buy back shares.

But in practice? Schiff argues that such a move would only crash Bitcoin further, widening the discount and putting even more pressure on Strategy’s financials.

In Schiff’s view, it is a lose-lose situation. If Bitcoin’s price does not climb significantly, Strategy could be looking at bankruptcy. And even if the cryptocurrency survives, Schiff does not see Strategy making it through intact.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov