Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin (BTC), the largest cryptocurrency, is changing hands more than 75% down from its all-time high. Meanwhile, a number of macro indicators tell us that traders are on the verge of massive purchasing opportunities.

Bitcoin (BTC) is in very interesting phase: Fat Pig Signals group

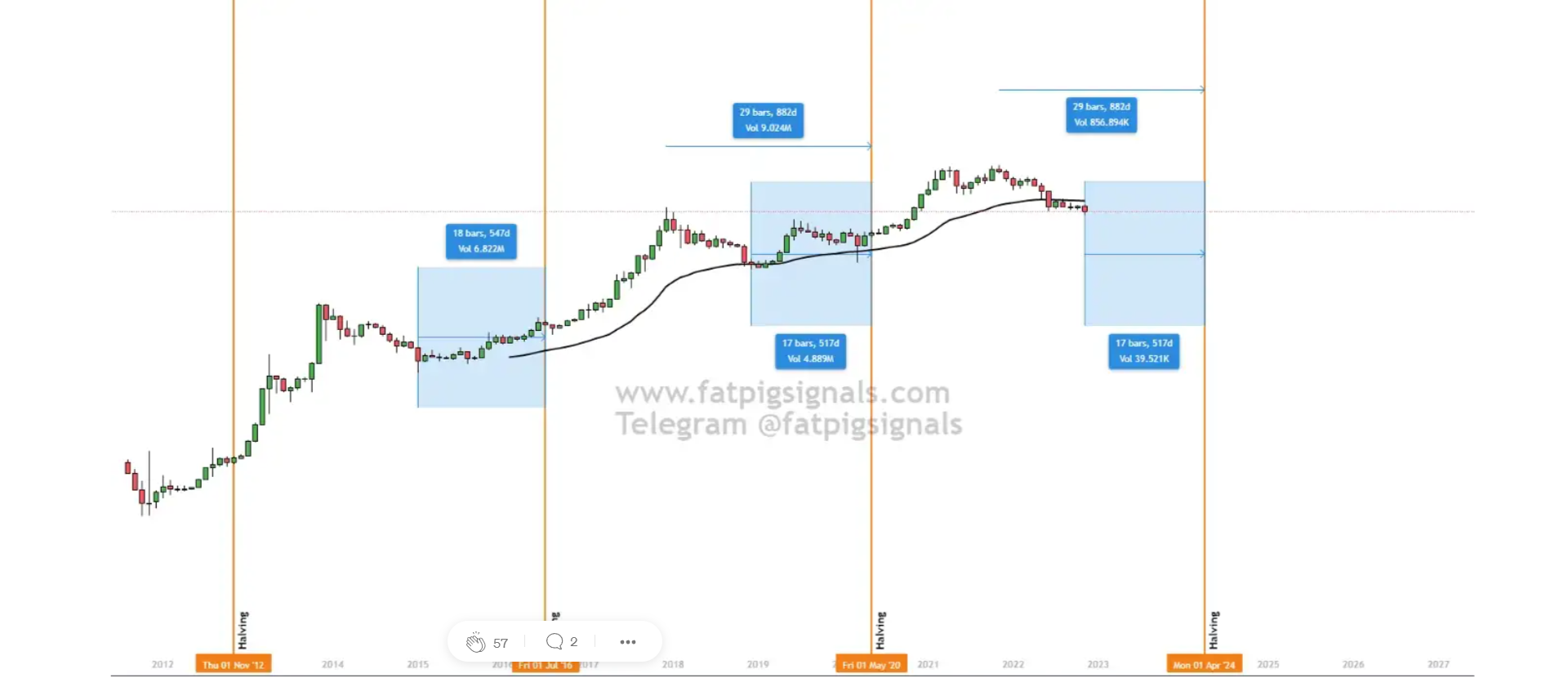

First and foremost, in terms of four-year Bitcoin (BTC) cycles, the market is on the eve of the "regular" bottom period. In two previous cycles, the orange coin bottomed 17-18 months prior to the next emission cut. Now, we have 17 months left to the crucial emission reduction in 2024. In 2024, miner reward will drop to 3.125 BTC per block for all miners on the network.

Typically, this period catalyzed the next bullish rally for the first cryptocurrency. Meanwhile, in terms of year-to-year performance, we should not expect eye-watering four-digit rallies as Bitcoin (BTC) and the industry as a whole are getting more and more mature and therefore less volatile.

While the 2012-2016 cycle resulted in a 4,918% upsurge of the Bitcoin (BTC) price, its 2016-2020 rally "only" made its price rocket by 1,414%. That said, it is highly likely that this was the last cycle with over 10x returns ("peak-to-peak"). This pattern is called diminishing returns, and it signals about the progress of the asset.

It is also interesting to track maximum drops of the Bitcoin (BTC) price for various cycles. In the first cycle of its mainstream adoption, it reached its bottom after an 86.9% drop, while the second recession ended after an 84% drop. Given the fact that Bitcoin (BTC) is currently changing hands with a 75% discount to its all-time high, the price might drop to $10,350 — but this would be the last phase before the upsurge.

Reliable historical indicators look positive for BTC bulls

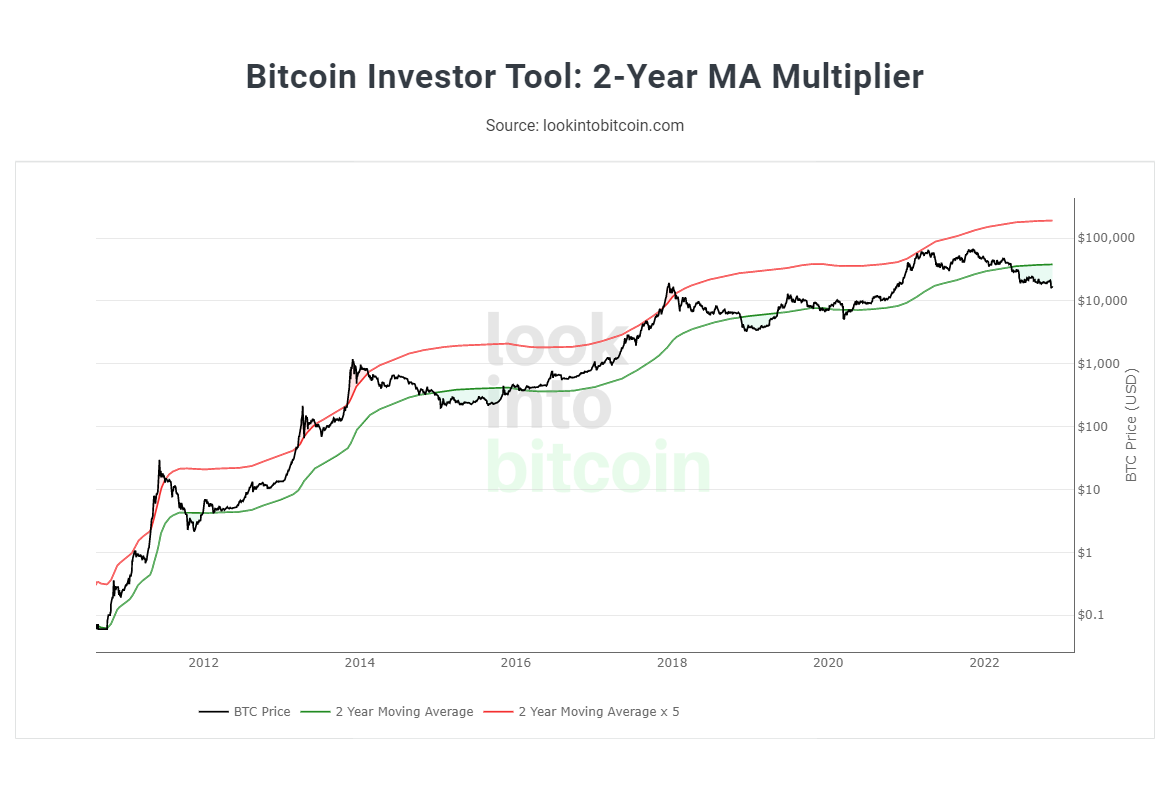

Another indicator that hints at possible purchasing opportunities is the 730MA line, i.e., the average price of Bitcoin (BTC) for two years prior to the current day and two years after this day. Should we draw this line and then the line with 730MAx5 values, we can witness two periods in every cycle.

When the price was below 730MA (green spaces on the chart, log scale used), it was historically the best opportunity to purchase Bitcoin (BTC) for a long-term investment strategy. The ongoing period started in early 2022, while the previous one, the shortest one in the entire Bitcoin history, coincided with Black Thursday in crypto on March 13, 2020.

By contrast, "red" zones should be interpreted as the perfect "sell" opportunity periods. The last one was registered in Q1, 2021, when the first crypto set its first peak in a bullish rally over $65,000. However, analysts highlight that past performance does not guarantee returns in the future: BTC might stay in an "accumulation" zone for a very long period of time.

These calculations are not designed to foresee the accurate day of the next Bitcoin (BTC) cycle bottom, analysts claim. Meanwhile, they could be productive in terms of identifying "oversold" and "overbought" phases.

Best risk/reward for long-term Bitcoiners

In general, despite the fact that the worst may be yet to come for Bitcoin (BTC) bulls, the whole situation tells traders that the "risk/reward" indicators look way more attractive than in 2021.

Launched by a hard-hitting team of cryptocurrency enthusiasts, Fat Pig Signals is among the most reliable Telegram groups with technical analysis and buy/sell signals for Bitcoin (BTC) and major altcoins.

Their analysts broadcast signals based on a multi-product research platform. Both free and paid membership options are offered by Fat Pig Signals; paid plans start at 0.1 Ether (ETH) per month.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov