Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin's dominance in the cryptocurrency market has surged to its highest level this year. But what does this uptick in dominance signify, especially for altcoins and the broader crypto ecosystem?

Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that Bitcoin holds. When Bitcoin's dominance rises, it often indicates that investors are favoring Bitcoin over other altcoins. This could be due to a variety of reasons, such as increased confidence in Bitcoin's stability, technological advancements, or significant news events related to Bitcoin.

On the flip side, high Bitcoin dominance can spell a period of stagnation or decline for altcoins. If investors are flocking to Bitcoin, it might mean they are moving their funds away from altcoins, leading to potential price drops for these alternative cryptocurrencies.

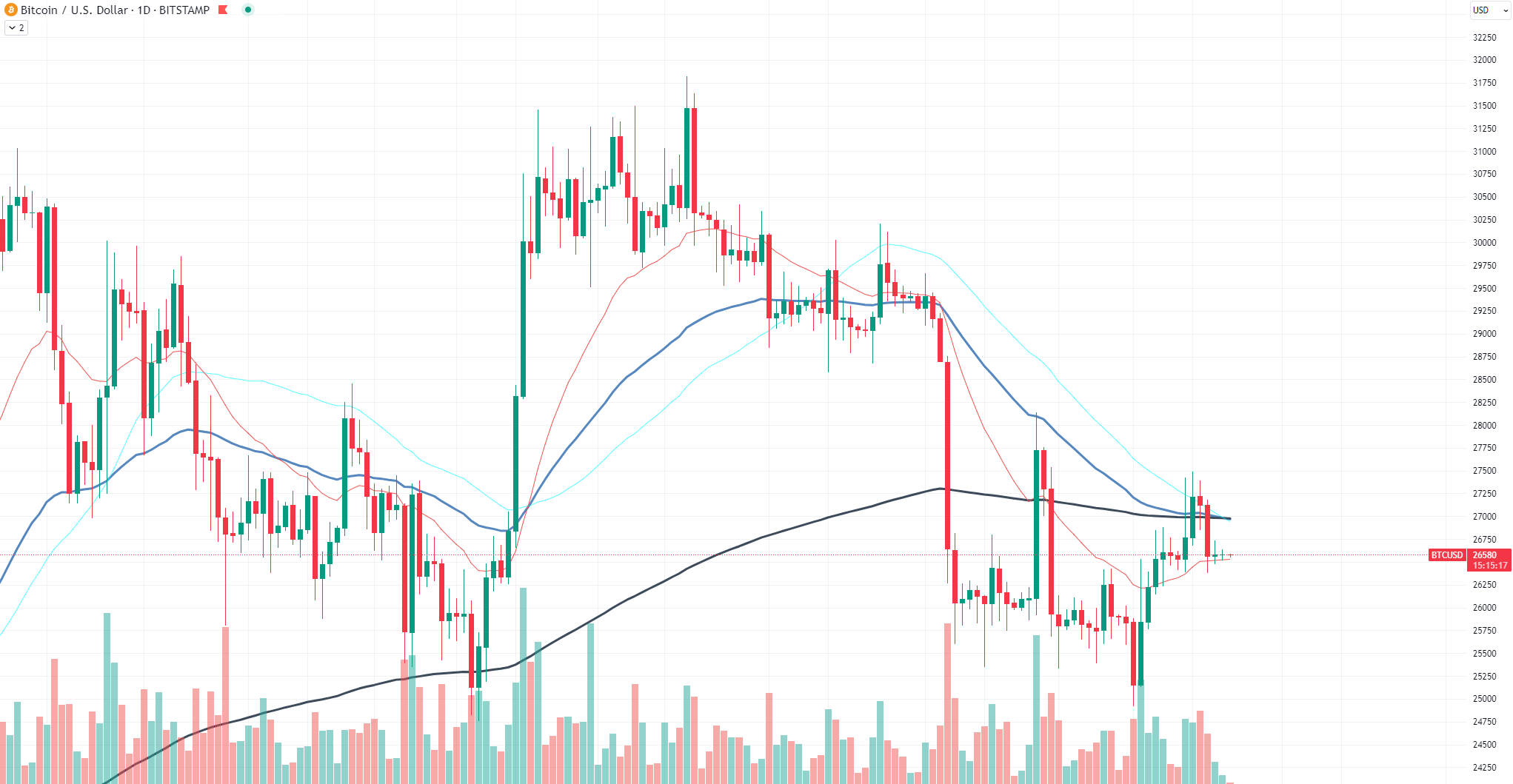

Let's delve into the recent price performance of Bitcoin. Over the past week, Bitcoin has shown mixed dynamics with a 50 EMA breakthrough and reversal below 200 EMA a few days after.

Now, considering Ethereum, which is often viewed as the leading altcoin, its price performance has been rather negative, reversing at local resistances and losing volatility. While Ethereum has its own unique features and use cases, its price often moves in tandem with Bitcoin. However, when Bitcoin's dominance rises sharply, Ethereum and other altcoins might not see the same level of growth.

Another factor to consider is the rising hashrate of Bitcoin. The hashrate is a measure of the computational power being used to mine and process Bitcoin transactions. A rising hashrate indicates increased network security and miner confidence in the profitability of mining Bitcoin. This could be another reason behind Bitcoin's growing dominance.

Historically, Bitcoin has gone through cycles of bull runs followed by bear markets, roughly every four years, often influenced by its halving events. If we are currently in a particular phase of this cycle, it could further explain the shifts in market dominance.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin