On Monday, March 23, the US Fed Reserve made an announcement about preparing to launch a slew of new QE programs to help the financial system perform well in the current crisis, as reported by CNBC.

Now Bitcoin bulls on Twitter are going wild with joy, sharing their ultra-optimistic sentiments.

'QE Infinity' is on

The Fed intends to carry on with its asset purchasing initiative “in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.”

The statement issued by the Fed states:

“While great uncertainty remains, it has become clear that our economy will face severe disruptions. Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.”

Anthony Pompliano posted a reminder that previously, the Fed announced a target of $700 bln to be injected into the financial system. Now, the regulator states that they are going to buy an unlimited amount of treasuries and mortgage bonds.

"Remember the $700B program the Fed announced to buy Treasuries & mortgage-backed securities last Sunday? Remember how it was supposed to be the BIG solution? Well they just announced they are increasing the $700 billion target to "unlimited" and will buy any type of bonds now."

Advertisement

Bitcoin bulls are stirring

Crypto Twitter is full of bullish posts from crypto experts who are sharing their optimism regarding the impact of the new QE measures on the price of Bitcoin ahead of the halving in less than two months.

Now this is good for #?from=article-linksBitcoin. Also Bitcoin fixes this.https://t.co/L1AXkQhRve?from=article-links

— WhalePanda (@WhalePanda) March 23, 2020

?Fed will buy unlimited amounts of Treasuries and mortgage securities. There is only 21 million #?from=article-linksBitcoin. https://t.co/4DsaUri97b?from=article-links

— Gabor Gurbacs (@gaborgurbacs) March 23, 2020

?Federal reserve to buy investment grade #?from=article-linkscorporate #?from=article-linksbonds and #?from=article-linksETFs among other heavy-duty market stabilization measures. They should buy some #?from=article-linksBitcoin too, to hedge against the Fed itself. https://t.co/KxjqMoxXv6?from=article-links

— Gabor Gurbacs (@gaborgurbacs) March 23, 2020

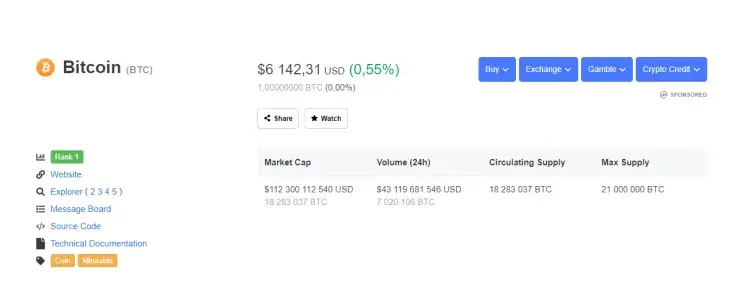

Bitcoin breaks $6,000 level

Now that the news is going around, Bitcoin has broken through the $6,000 level and crypto traders are offering bullish predictions. Analyst ‘Crypto Michael’ tweeted that BTC is likely heading for $6,800.

Flipping this level will allow it to surge higher.

$BTC #?from=article-linksBITCOIN

— Crypto Michaël (@CryptoMichNL) March 23, 2020

Thank you FED, Unlimited QE!

We're getting those higher tests at $6,400-6,500 and maybe even $6,800-6,900, it looks like.

Bias remains the same until we flip $6,800 for support. pic.twitter.com/gA8Mqjt6kW

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin