Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The price of Bitcoin (BTC) continues to fall — that would be enough to describe the current situation in the cryptocurrency market. However, and fortunately, it's a place where things rarely stay the same for long, and the upcoming month of April has a great chance to prove this point.

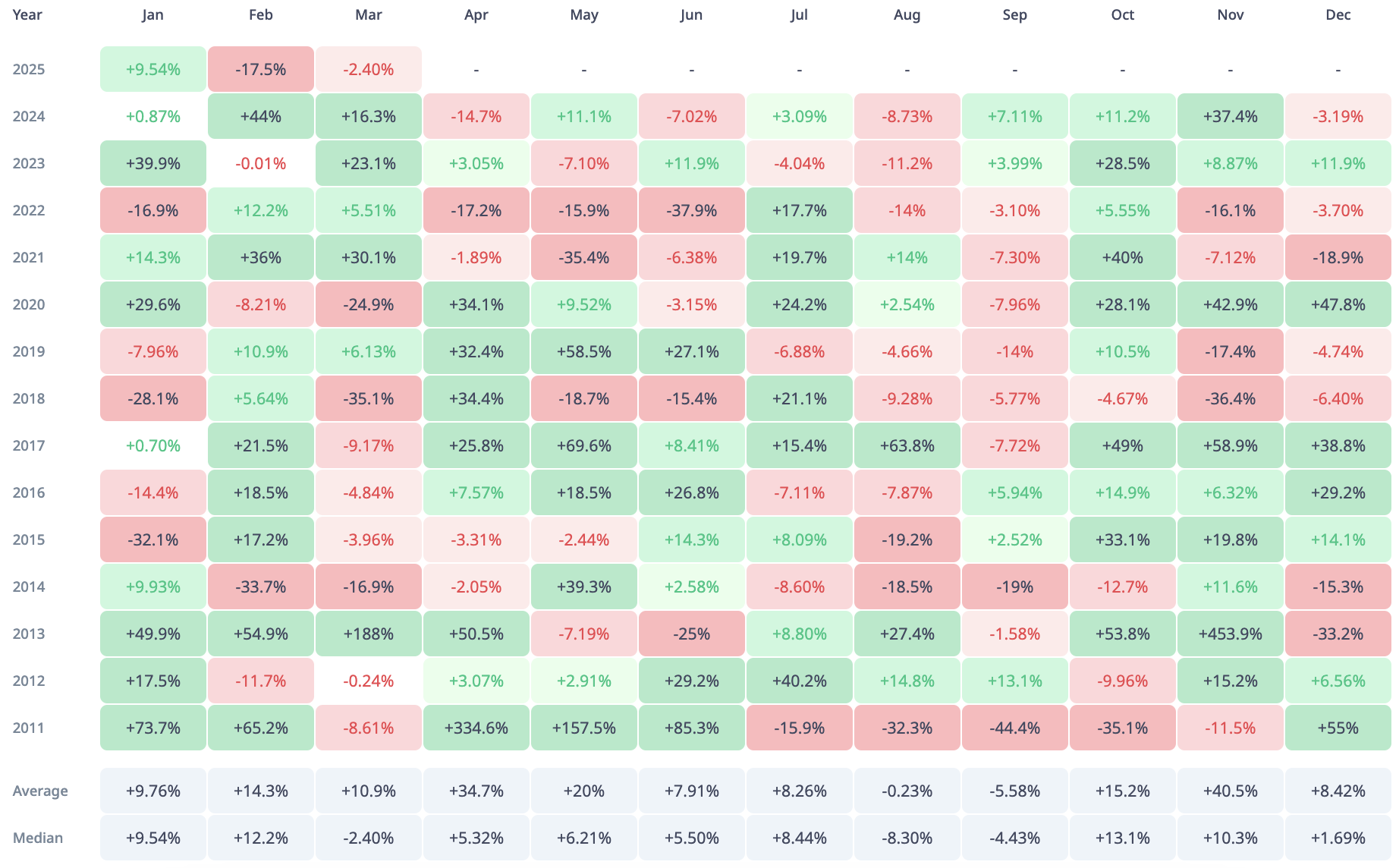

Thus, as it became known thanks to data from CryptoRank, the average return for Bitcoin in the fourth month of the year stands at 34.7%, and this is actually the second best month in the price history of the cryptocurrency in terms of gains.

Only November was better with an average return of 40.5%. Moreover, an even more accurate and time-adjusted median indicator also signals gains for Bitcoin in the coming month with a figure of 5.32%.

On the one hand, the price of BTC and April, or "Upril" and "APEril" as some crypto enthusiasts call this month, are a good pair from a historical perspective.

On the other hand, as it is always the other way around, Bitcoin has only closed April with a gain once since 2021, and that was a 3.05% spike in 2023.

Yes, one can argue that 2022, 2023 and even 2024 were bear market and then rally years. Still, the historical facts are there and they put a cold shower on the hopes of a 34% jump in Bitcoin next month.

All in all, price history is just one of the tools used to try to predict what will happen next in the crypto market, and the insights from it are not set in stone. For Bitcoin though, it offers a bit more as the asset itself has been publicly traded for over 14 years, so the stat cut is big enough.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov