Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Against the backdrop of Bitcoin's - to put it mildly - less than encouraging price behavior, and as a consequence that of the entire crypto market, the voices of skeptics and critics of the new asset class have begun to erupt publicly again.

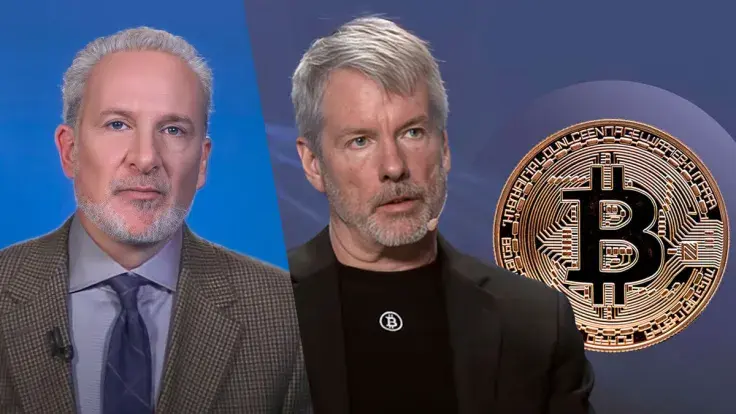

Thus, in a recent series of posts, Peter Schiff has questioned the stability of cryptocurrency and MicroStrategy, raising concerns about the potential for a crash. Despite the buying activity of 11 spot Bitcoin ETFs, Schiff pointed out that BTC has been trading sideways for over three months and is currently 11% below its March high.

He questioned the market dynamics, asking who has been selling Bitcoin if ETF investors have been consistent buyers, and what might happen if these ETF buyers lose patience and start selling their holdings.

Schiff then speculates that hedge funds may play a pivotal role in this scenario, suggesting that these funds may be buying Bitcoin or ETFs as part of a strategy to short MicroStrategy (MSTR), a company heavily invested in BTC under the leadership of CEO Michael Saylor.

Schiff's analysis implies a potential domino effect that could severely impact both Bitcoin and MicroStrategy. If the hedge funds decide to unwind their trades, they would have to sell their cryptocurrency holdings. This influx of selling could lead to a sharp decline in the price of Bitcoin. Such a crash would, in turn, put additional downward pressure on MicroStrategy.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov