Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Since the publication of this article, Binance has provided further clarification on the changes to its Terms of Use. The company asserts that these changes were made to protect users and their assets, particularly those termed 'zombie assets', which could potentially get trapped in users' accounts. For more details and updates on this story, please refer to our newly updated article.

One of the world's leading cryptocurrency exchanges, Binance, has made a significant yet silent change to its Terms of Service, potentially affecting all users on the platform. The changes primarily focus on the management of digital assets that are no longer listed on the platform.

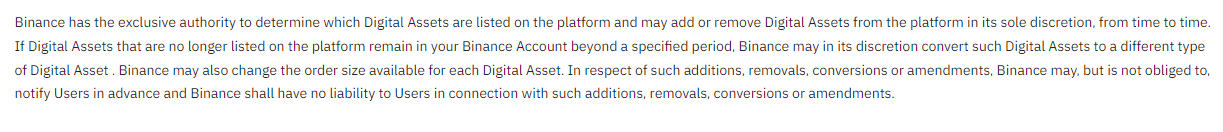

According to the new terms, Binance now holds exclusive authority to determine which digital assets are listed on their platform, and it reserves the right to add or remove these assets based on its discretion.

This is standard practice for most exchanges, but the new terms take it a step further. If a user still has a delisted digital asset in their Binance account after a certain period, Binance reserves the right to convert these digital assets into a different type of digital asset of their choosing.

The implications of this change are significant. The exchange is under no obligation to notify users of this conversion in advance, and it absolves itself of any liability linked to such conversions. The new terms also note that Binance may change the order size available for each digital asset.

An alarming interpretation of the changes suggests that delisted cryptocurrencies could potentially be converted into Binance's native token, BNB. While this is speculative, the lack of transparency regarding the type of digital asset Binance could convert to raises this concern among users.

These alterations come after the U.S. Securities and Exchange Commission (SEC) sued Binance US for operating as an unauthorized exchange in the country. The silent change to the terms could be seen as a response to regulatory pressures. This serves as a potent reminder to users to remain vigilant about the terms of service of the platforms they use, which are subject to change.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov