Social Capital founder Chamath Palihapitiya says that he’s still sizing up his Bitcoin holdings in his Sept. 23 tweet.

He also claims that “nothing” could compare to his Bitcoin bet that he made in a distant 2012:

“Take the time to understand what you own. So deeply that you could be “all in” if necessary. It should never come to pass but if you have this level of conviction, you will size and add appropriately and let your slugging percentage do all the talking.”

Strong hands

The billionaire named the flagship cryptocurrency as an example in his about the importance of the slugging percentage in investing.

The term, which originally came from baseball, takes into account the consistency of fund managers instead of simply paying attention to absolute returns.

During Social Capital’s recent investment conference call, Palihapitiya claimed that his firm first got into BTC back in 2013.

The cryptocurrency was among the company’s largest investments back in 2018 but it’s not clear how many coins his firm holds as of now.

The next Berkshire Hathaway

Palihapitiya is currently at the forefront of the global SPAC craze with his ambitious bets that could turn him into the next Warren Buffett, the CEO of Berkshire Hathaway.

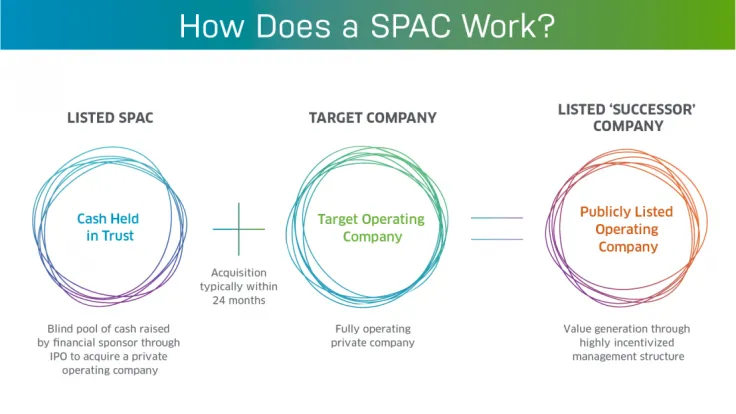

SPACs, an acronym that stands for “special purpose acquisition companies,” represent a relatively new capital-raising technique that has skyrocketed in popularity as of recently. SPAC IPOs make it possible to go public within weeks by reducing red tape.

After the Virgin Galactic IPO, Palihapitiya also took private real estate startup Opendoor public earlier this year through one of his SPACs.

While Buffett continues to dismiss Bitcoin, Palihapitiya’s bet paints a bright future for the top cryptocurrency.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin