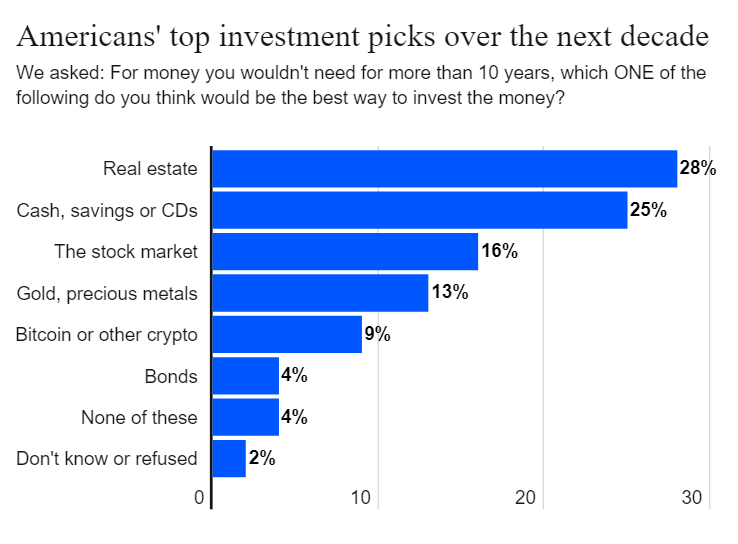

More Americans are willing to invest in gold compared to Bitcoin over the next ten years (13 percent and 9 percent, respectively), according to a recent survey conducted by New York-based consumer financial services company Bankrate.

Stocks, cash, certificates of deposit (CD) are also more popular than crypto with U.S. investors.

Real estate has topped the list, with 28 percent of respondents saying that they are willing to put their money into it.

The majority of the survey participants (61 percent) are either “not too comfortable” or “not comfortable at all" with crypto.

Unsurprisingly, most millennials, who are aged between 25 and 37 years, have the opposite attitude to crypto. Meanwhile, baby boomers are overwhelmingly bearish: only 16 percent of them are okay with crypto.

Inflation talks falling on deaf ears

Another notable takeaway from the Bankrate survey is that 58 percent of all the surveyed Americans claim that inflation won’t influence their investment choice.

This, of course, flies in the face of the “inflation hedge” narrative that is being routinely pushed by both gold and Bitcoin supporters.

Only 20 percent of the survey participants are willing to invest more aggressively if inflation spikes.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin