Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Cryptocurrency trader and analyst "Rekt Capital," who prefers to remain anonymous, gave his opinion on what the future may hold for altcoins. According to the crypto enthusiast, if altcoins lose the fight to overcome key resistance levels, there could be another big drop waiting for them. The decline in alt prices could be up 30% in an unfavorable case.

If things stay the same and Altcoins continue to struggle to breach key resistances...

— Rekt Capital (@rektcapital) July 11, 2022

Altcoins may need to experience at least an extra -30% of downside#BTC #Crypto #Bitcoin

Bitcoin (BTC), on the other hand, according to Rekt Capital, demonstrates overselling based on data science models. At the same time, its price behavior, which is not notable for an abundance of activity, does not change this fact, the analyst said.

How does altcoin index Total 2 describe current situation?

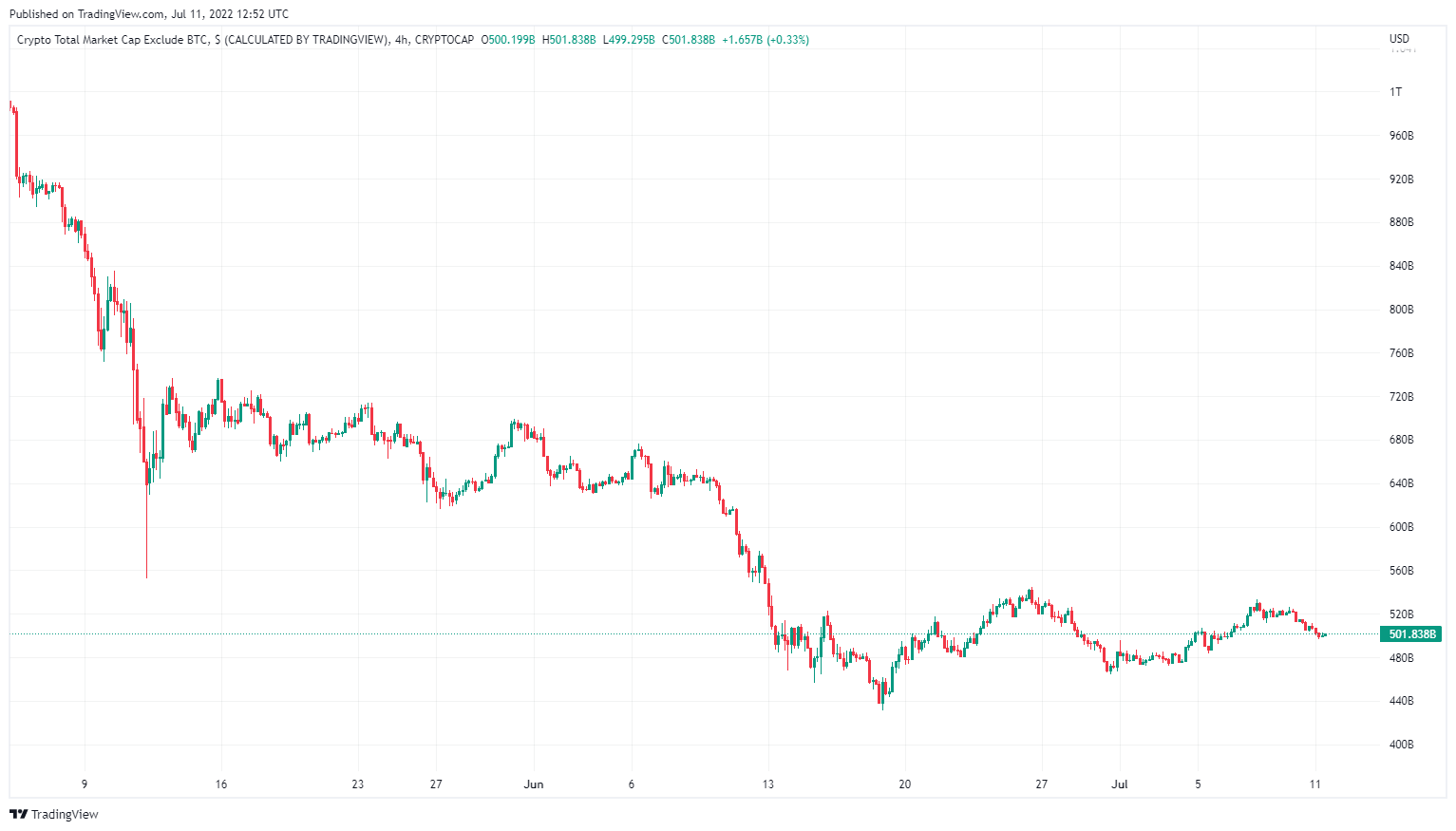

It is not always necessary to resort to complex statistical models to assess the overall situation of altcoins. The Total 2 Crypto Market Cap Index, which excludes BTC and tracks the weighted average capitalization of ETH, BNB, LTC, XRP, ADA, DOT and the other altcoins, can also be useful in this case.

Thus, the index shows that after the second capitulation phase, which lasted for the first two weeks of June, altcoin prices have fallen into a range whose spread can be estimated to be around $100 billion. The upper boundary of the corridor, at around $540 billion, is a resistance that has been attempted to be breached twice. Having failed to overcome this mark, altcoins continued a low-volatile consolidation in the range, in the middle of which they are trading at the moment.

Rekt Capital's hint becomes clear when we look at what happened to alts from May through June. At that time, after the first major sell-off, altcoins also found themselves locked in a similar price corridor and, unable to get out of it for a month, suffered a notorious 30% drop in their total capitalization.

The first accumulation lasted almost a month until the next spill, and the second is nearing the end of that period. If history repeats itself, we will see its outcome soon enough.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov