Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

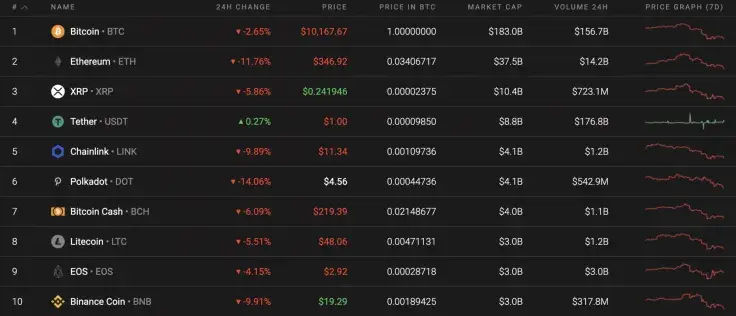

The bearish sentiments have become even more powerful over the weekend as all of the Top 10 coins are in the red. Polkadot (DOT) and Ethereum (ETH) are the key losers, falling by 14% and 11% respectively.

Below is the main data for Cardano (ADA), Stellar (XLM), and Chainlink (LINK):

|

Name |

Ticker Advertisement

|

Market Cap |

Price |

Volume (24H) Advertisement

|

Change (24H) |

|

Cardano |

ADA |

$2,424,507,092 | $0.093513 | $426,620,368 | -8.55% |

|

Stellar |

XLM |

$1,582,810,412 | $0.076673 | $233,047,005 | -5.44% |

|

Chainlink |

LINK |

$3,870,361,639 | $11.06 | $1,400,123,814 | -9.27% |

ADA/USD

Cardano (ADA) is no longer in the Top 10 list. For the moment, it is located in 11th place, falling by 8.55% in the last 24 hours.

Looking at the daily chart, Cardano (ADA) has reached a local support level, which means that a bounce off is likely to occur. What is more, the Relative Strength Index (RSI) is almost on to the verge of the oversold area, which is also a signal for a potential rise. Respectively, the growth may last until the altcoin reaches the $0.1080 mark.

At press time, Cardano was trading at $0.0944.

XLM/USD

The rate for Stellar (XLM) has dropped the least as compared to other coins from the list. Since yesterday, the decline accounts for 5.44%.

Stellar (XLM) is also looking as bullish as Cardano (ADA). Looking at the weekly time frame, the ongoing drop might be considered a correction before a continuation of growth. This is because the long-term trend remains bullish.

Thus, the selling volume is low, which means that the bears are unlikely to push the rate downwards. That is why the more likely price action would be to reach the local resistance level at $0.0857.

At press time, Stellar was trading at $0.077.

LINK/USD

Chainlink (LINK) is today's biggest loser. The price for the coin has gone down 9.27% from the previous day.

From a technical perspective, Chainlink (LINK) might have already stopped declining as the bulls has gained enough strength for continuing the upswing. The selling volume is decreasing, and the liquidity is low, which means that there are fewer bears that will want to sell at the current prices. All in all, the rate of Chainlink (LINK) may come back to $13.28 by the end of the month.

At press time, Chainlink was trading at $11.48.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin