Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Prominent blockchain tracking platform Whale Alert, which monitors large cryptocurrency transfers and shares the details on its official X account, has spotted six consecutive Ethereum transfers, each carrying slightly more than $100 million worth of ETH.

All these transactions took place within a single hour, according to the on-chain data source.

168,000 ETH moved mysteriously to unknown wallets

As stated above, several hours ago, Whale Alert spotted six massive cryptocurrency transactions, each carrying approximately 27,970 ETH. Each of these transactions was worth roughly between $100.5 million and $100.7 million in fiat.

All of them were transferred between anonymous blockchain addresses, totaling roughly 168,000 ETH valued at $603,385,283 as of this writing.

This anonymous whale activity took place as the price of the second biggest cryptocurrency by market capitalization size, Ethereum, printed a surge of almost 6%, going up from $3,430 to touch on the $3,628 price mark. By now, ETH has seen a small drawdown of approximately 1.5%, and at the time of this writing, it is changing hands at $3,575.

BlackRock Ethereum ETF hits big new milestone

In the meantime, a Chinese cryptocurrency journalist and blogger Colin Wu has reported that on Friday, Jan. 3, the overall net inflow in post Ethereum exchange-traded funds (ETFs) constituted an impressive $58.78 million. The lion share of that comprised the net inflow of BlackRock’s ETHA — in a single day, it welcomed $33.88 million.

As of now, the total inflows of BlackRock’s Ethereum ETF has reached the $3,559 billion mark.

Still, on the same day, BlackRock’s Bitcoin spot ETF IBIT faced the largest single day outflow of $332.6 million equal to approximately 3,413 BTC. This is the largest single outflow since the ETF’s launch, which even exceeded the previous one spotted Dec. 24, when $188.7 million worth 1,933 BTC were dumped by the exchange-traded fund operated by BlackRock giant.

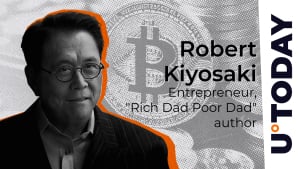

During the last week of 2024, renowned Bitcoin investor Robert Kiyosaki criticized BlackRock and its boss Larry Fink for selling BTC. Kiyosaki stated that BlackRock was dumping Bitcoin to keep its price below $100,000 to allow whales to buy digital gold at a large discount. Many influencers on the X app then drew public attention to these huge BTC outflows of BlackRock.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov