Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

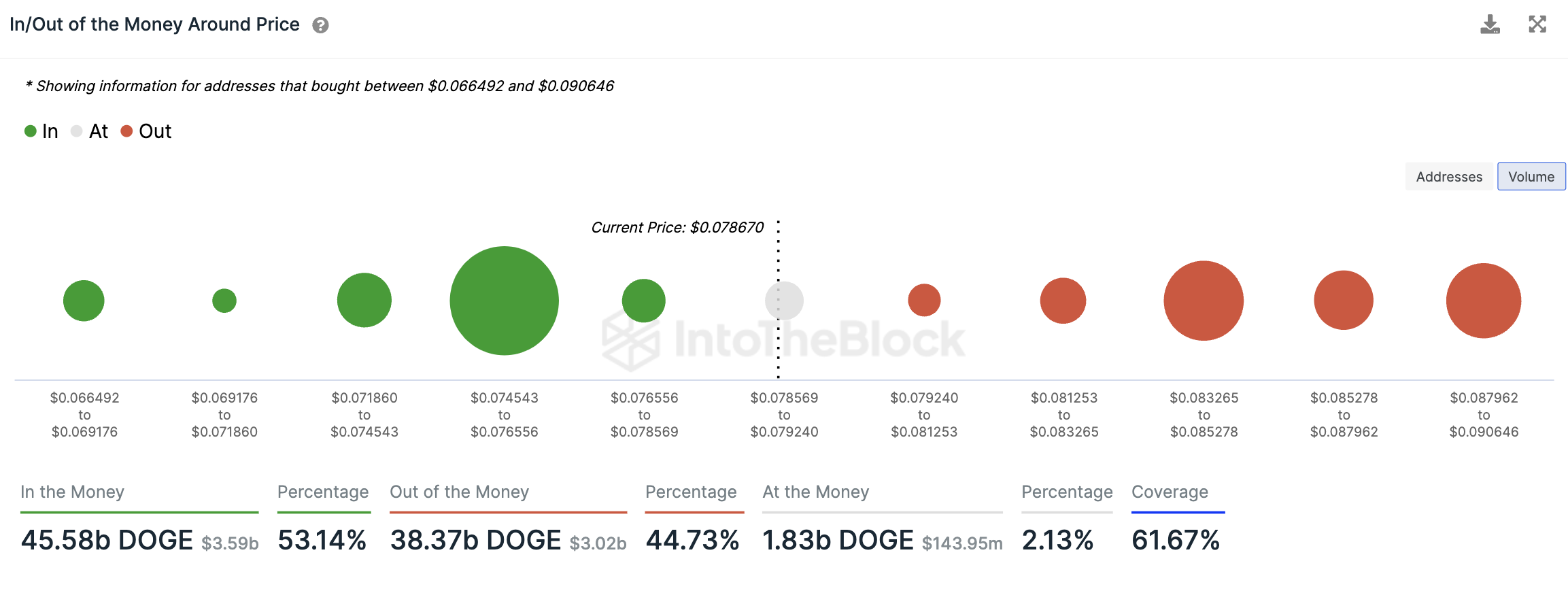

More than 101,270 Dogecoin addresses are at risk of losing their positions if the price of DOGE drops to the $0.745 per token level. This is evident from data from crypto intelligence portal IntoTheBlock.

According to the data, over 37.2 billion DOGE were bought at the $0.745 to $0.786 area, making this the largest of the clusters near the current Dogecoin price of $0.79. Moreover, if the data is to be believed, this number represents almost half of all Dogecoin purchases now in profit, $74.38 billion DOGE.

About 40 billion Dogecoin went underwater amid a decline that began last Wednesday at $0.941 per DOGE. This volume is spread across more than 594,000 addresses. DOGE itself has lost nearly 13% since then on this wave of decline. The explosion of Elon Musk's Starship super-heavy rocket from SpaceX added particular drama to the token's price action.

However, at the moment, Dogecoin is still more of a profit-making than a loss-making crypto asset. Thus, the share of addresses in the money in DOGE is 53.72%, which is 2.41 million addresses of the total number. The ratio is obviously fragile, given that more than half of the coins now in profit could turn red, as mentioned above.

What happens next is an open question, given the sudden change in trend and sentiment on the crypto market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov