Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

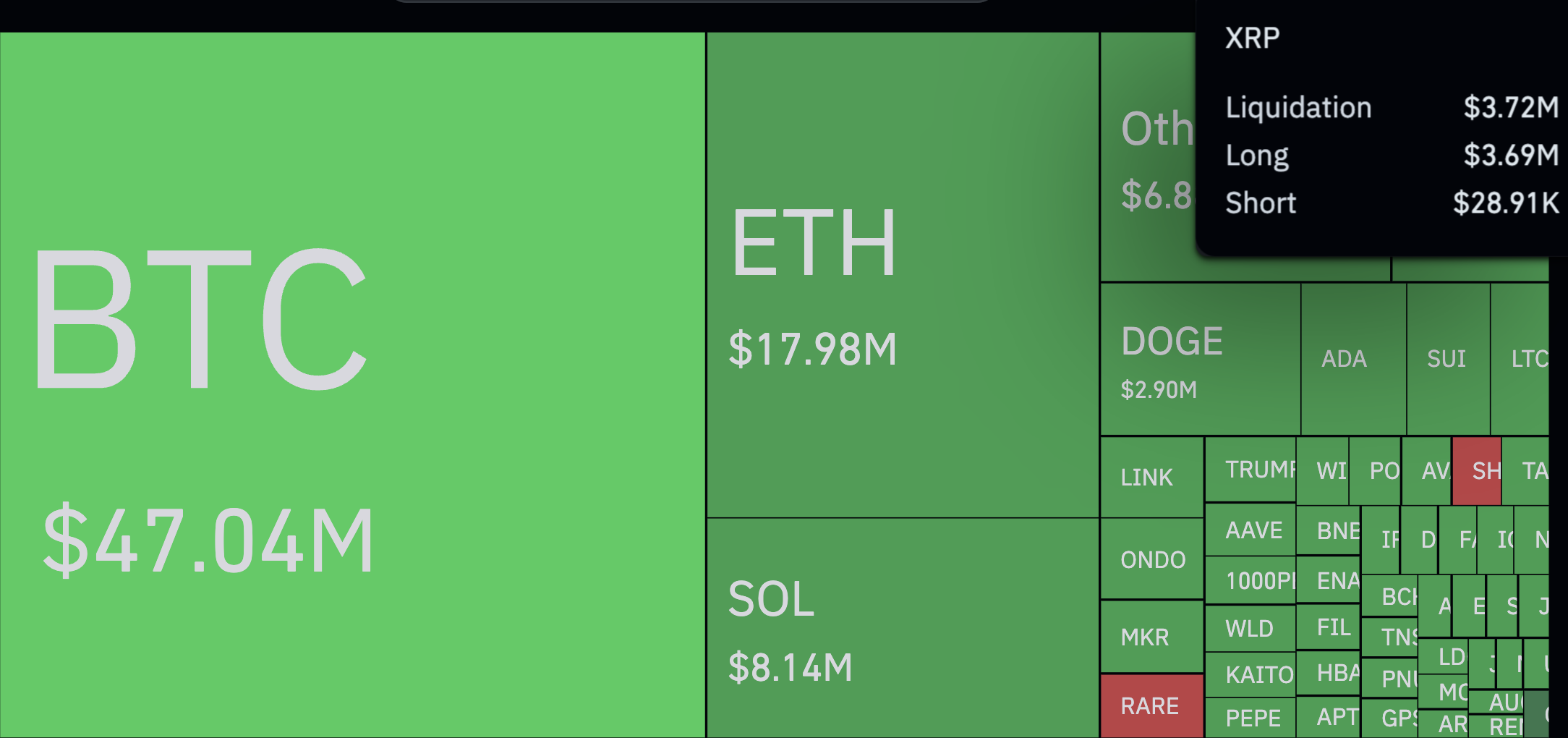

We are seeing wild numbers, which is not uncommon in crypto. The last hour saw liquidations hit nearly $109.74 million, according to CoinGlass data. Market swings happen fast, but this one stands out, not because of the amount but because of how it played out.

Long positions took the biggest hit - 88.94% of the liquidated volume came from traders betting on price increases in the derivatives market. Shorts? Just $12.23 million. The imbalance is massive. But in some cases, like XRP, it is even bigger.

Thus, short liquidations on the third largest cryptocurrency barely registered at $28,910, while long liquidations soared to $3.69 million. It is a difference of 12,763%. The price itself is only down 2.73% in the same time frame. It is a small dip but enough to trigger a wave of forced selling that wiped out overly optimistic traders.

XRP is no stranger to volatility, but today it stands out. It is a clear sign of the bullish sentiment that existed before the crash - a sentiment that, at least for now, has been dealt a heavy blow.

The timing of it all was not random. Earlier, Strategy, led by Michael Saylor, announced a $21 billion offering to buy more Bitcoin. The market took it well at first. Optimism crept in, but then reality hit. The U.S. stock market opened, the S&P 500 dropped to its lowest level since September 2024 and sentiment flipped. Crypto followed.

Traders were caught on the wrong side of the trade. Again. The market does not wait for second chances. If anything, today’s events serve as a reminder - leverage is a double-edged sword - and in times like these, it cuts deeper.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin