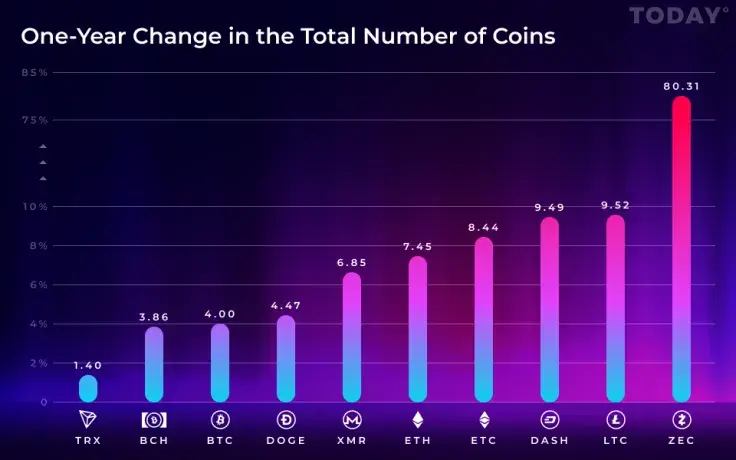

New DataLight study reveals what cryptocurrencies had the biggest one-year change in the total number of coins. Zcash (ZEC) leads the pack with a whopping 80.31 percent increase.

Zcash is in the lead

At press time, the total circulation supply of ZEC currently stands at 5.8 mln. For comparison, it had only 3.2 mln coins at the same point in 2018. Still, even with the above-mentioned increase, that’s a very low coin supply, and one of the leading privacy coins has plenty of room for growth.

Just like Bitcoin (BTC), ZEC has a fixed circulating supply of 21 mln. BTC, the world’s flagship cryptocurrency, saw its number of coins grow by 4 percent. Bitcoin’s circulating supply exceeded 17 mln back in April 2018.

Meanwhile, Monero (XMR), the main competitor of Zcash in the privacy coin niche, is expected to have 18.4 mln coins in circulation by 2022. With a 6.85 percent yearly increase, there is currently 16.7 mln XMR.

Less is more in the world of crypto

Litecoin (LTC) and Dash (DASH) are in second and third places with their circulating supply growing by 9.52 percent and 9.49 percent respectively. Tron (TRX), for comparison, only witnessed a 1.4 percent gain, but it already has the biggest coin supply on the list with 66 bln TRX.

A small circulating supply creates more demand, which is why the likes of Bitcoin and Zcash can be considered scarce assets. Subsequently, many investors are shooed away by cryptocurrencies with mammoth-size supply, but the coin’s market cap is the only thing that matters in the end.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov