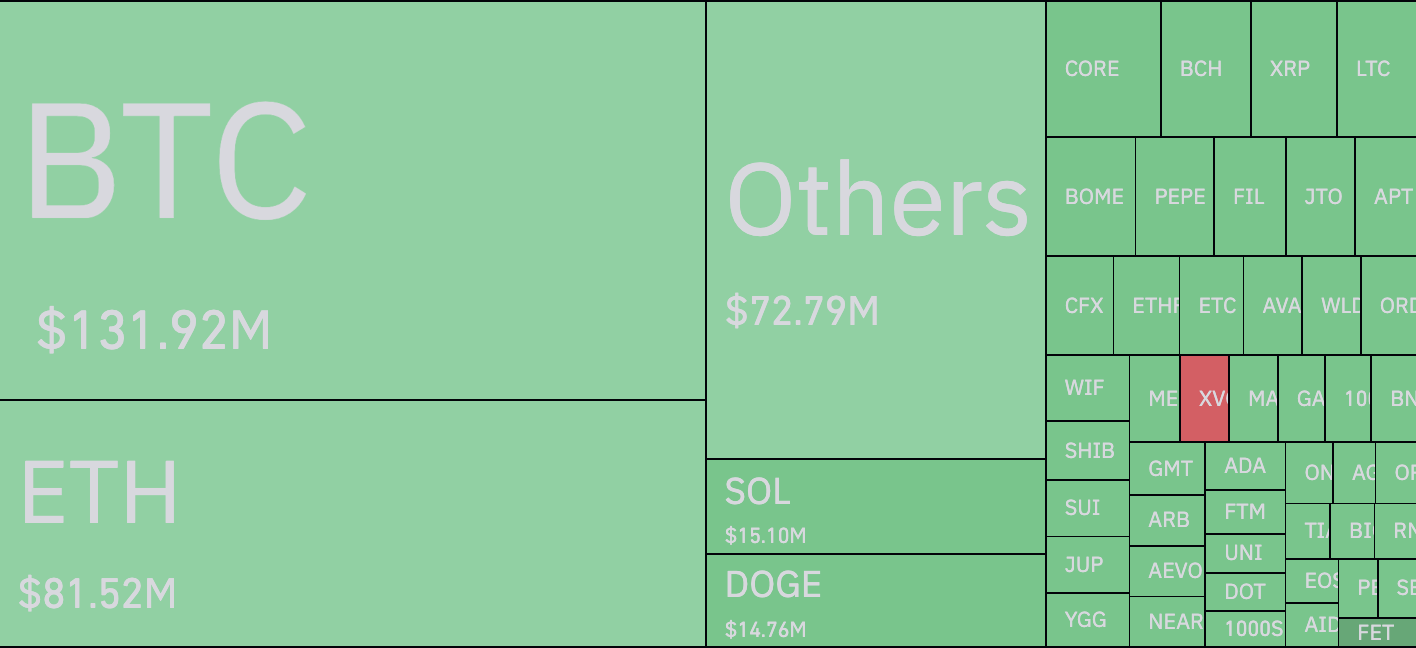

In an extra-volatile period on the crypto market, the trading volume of XRP, a popular cryptocurrency, surged by a staggering 80% within the past 24 hours, soaring to a value surpassing $4 billion.

CoinGlass reports that derivatives alone accounted for $2.16 billion, while spot markets added an additional $1.9 billion, marking a 55.4% increase from the previous day. Despite this substantial uptick, the token's market capitalization stands at $32.5 billion, translating to a trading volume-to-market cap ratio of 12.5%, signaling active but not extraordinary trading.

However, this surge in XRP trading activity occurred amid what can only be described as a crypto bloodbath. Liquidation statistics reveal that over $400 million worth of positions were forcibly closed, with an overwhelming majority — 85.5% — being long positions or purchases. The XRP market witnessed an even higher ratio, with 94% of liquidated futures positions representing long positions, totaling $5.47 million.

XRP price takes dip

This dramatic increase in trading volume coincides with a sharp decline in XRP prices, triggering stop losses and margin calls that forced buyers to hastily exit their positions. Consequently, the trading volume of the token experienced a notable surge, reflective of heightened market activity amid widespread sell-offs and liquidations.

While the surge in XRP trading volume is undeniably significant, it is essential to contextualize it within the broader crypto market landscape, characterized by extreme volatility and significant losses.

Despite the impressive volume figures, the market remains turbulent, with investors navigating through dark waters as they assess the implications of the ongoing bloodbath on their portfolios and the general crypto market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov