Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

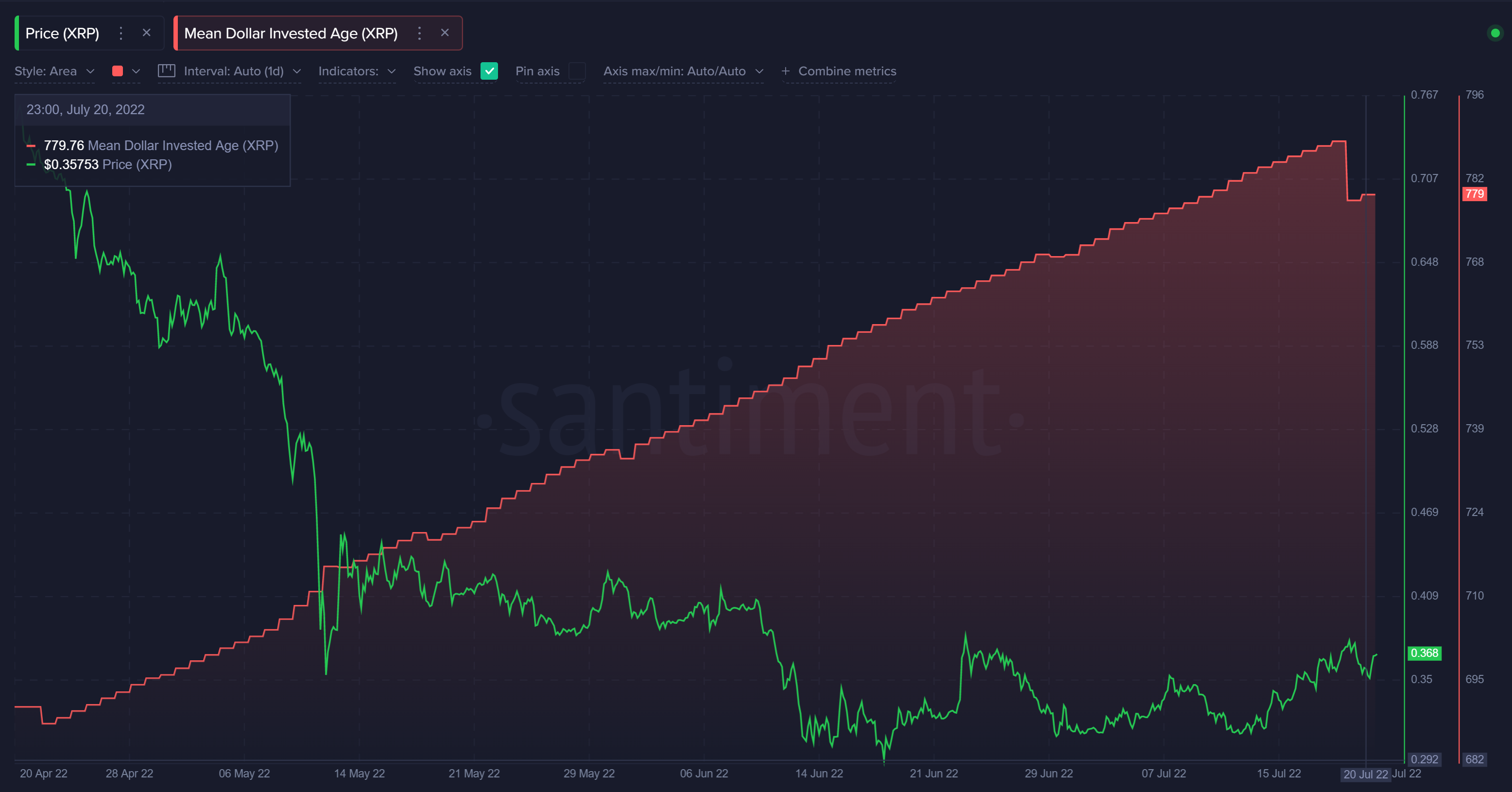

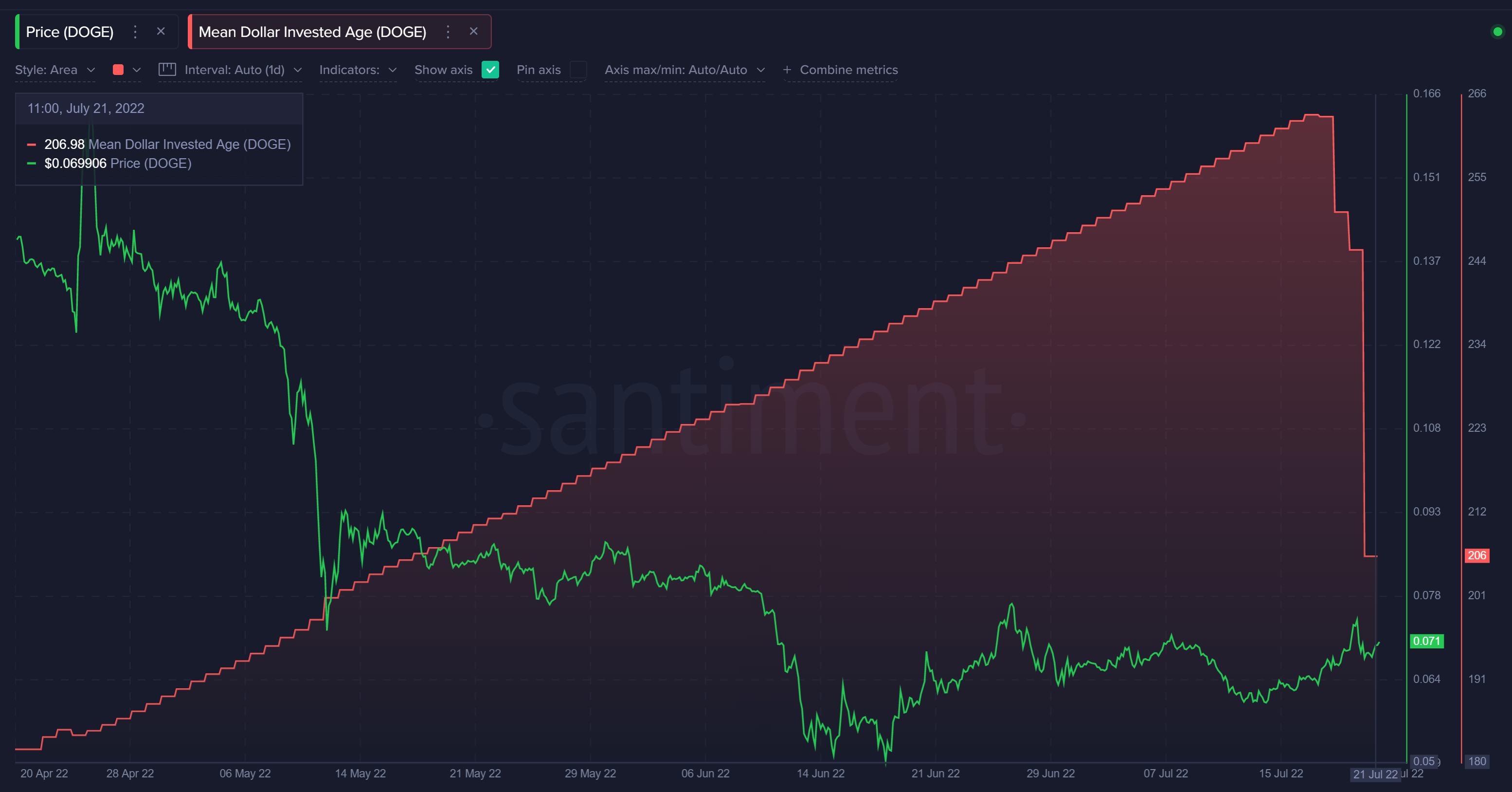

A Santiment member analyzed popular cryptocurrencies like XRP and Dogecoin (DOGE) and found that the prices of these coins are beginning to awaken. To conduct the research, the analyst used an unusual indicator called Mean Dollar Invested Age, which tracks the average age of all blockchain assets, weighted by purchase price or, more simply, the average age of an asset investment.

The indicator works extremely simply: if its value grows, this means that the asset is not moving and its storage becomes more and more dormant. Usually, this leads to stagnation of a cryptocurrency's price because the greater the number and age of unmoving coins, the less its price is able to grow.

If Mean Dollar Invested Age drops, this means that previously dormant addresses begin to wake up and move the cryptocurrency, which in turn signals possible imminent positive price changes.

XRP and DOGE insights

Until this week, MDIA to XRP had been rising steadily for three months when it saw a sharp decline of more than 10%, the biggest drop since December 2021. Then in December, the XRP price reacted with a 19% increase during the week. The current fall in MDIA also relates to recent alerts on suspicious activity around XRP.

The same applies to Dogecoin (DOGE), whose MDIA value has dropped more than 21.6% in the last three days. At the same time, the author notes that the fall may continue, which means DOGE should be watched attentively, given the coin's habit of surging in price.

MDIA is really an impressive metric, but the crypto market as all we know is an inherently unpredictable place, so it would be wrong to rely on just one tool. In any case, it is better to build logical chains on your own, but it is definitely worth keeping such metrics in sight.

Alex Dovbnya

Alex Dovbnya Tomiwabold Olajide

Tomiwabold Olajide Gamza Khanzadaev

Gamza Khanzadaev