Shibetoshi Nakamoto, co-creator of Dogecoin (DOGE), recently expressed concerns about the market's future, stating, "There will always be a crash at some point." His remarks came in response to the question of whether the stock market is currently in a bubble.

As of July 2024, the S&P 500 has been performing exceptionally well, hovering near record highs with a year-to-date return of approximately 15%. This impressive trajectory positions 2024 to be one of the best-performing years for the index in the last 25 years.

The technology sector has been a primary driver of this growth, with companies like Nvidia, Alphabet, Amazon and Meta experiencing significant stock price increases. This momentum reflects strong investor confidence in the ongoing expansion of artificial intelligence and other emerging technologies.

Laggard effect?

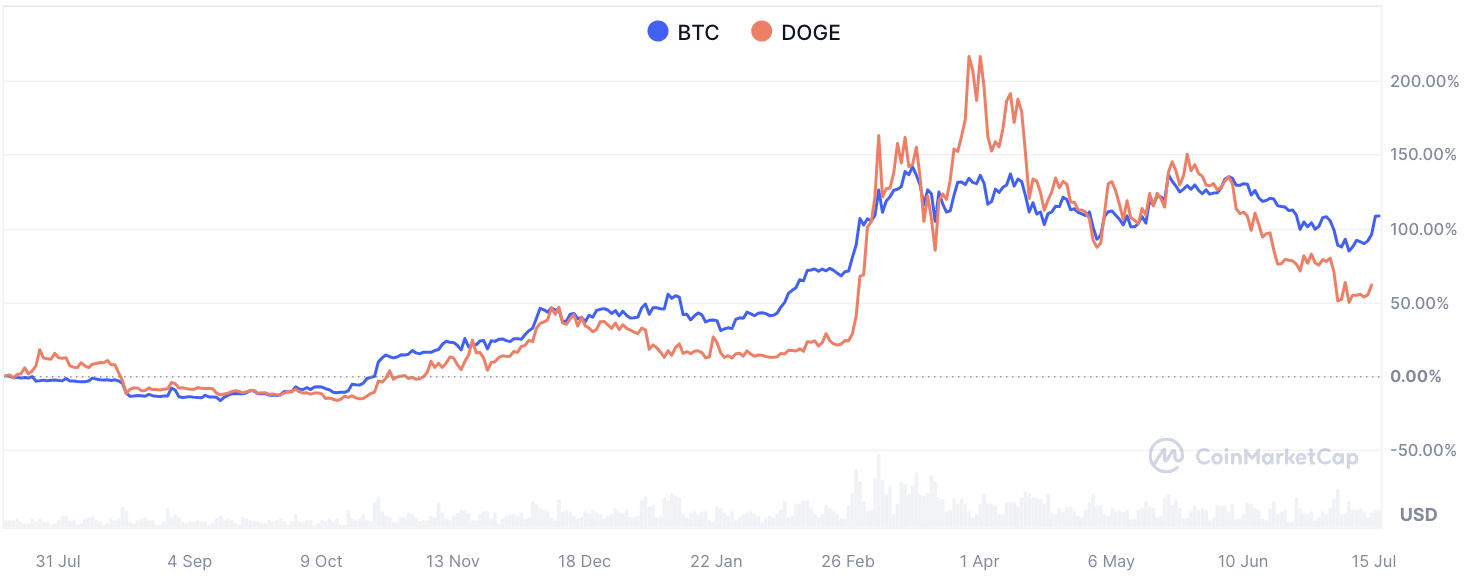

In contrast, the crypto market's performance has been more varied this year. Bitcoin saw significant growth leading up to the April 2024 halving event, even reaching a new all-time high. However, it also experienced notable downward movements, with billion-dollar liquidations indicating a volatile market. Bitcoin's price chart does not resemble the "up only" trajectory seen in the S&P 500.

For Dogecoin, the situation is even more subdued. Its year-to-date return stands at 32.6%, reflecting a less dramatic but still positive performance comparable to Bitcoin and the broader market.

Will the S&P 500 continue its upward trajectory, or are we on the brink of a market correction?

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov