Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

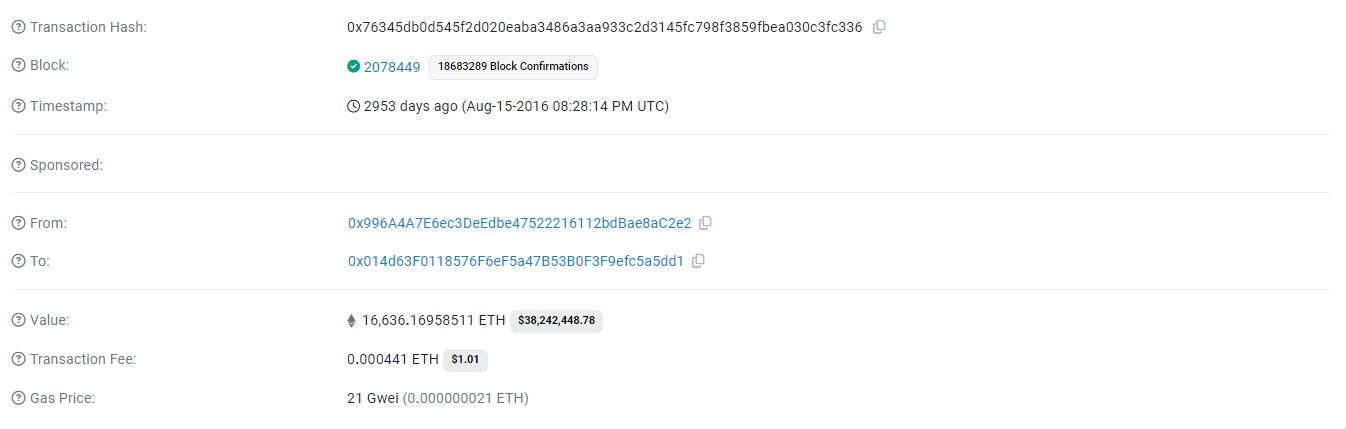

After holding the asset for more than eight years and achieving an amazing 446x return on investment, an Ethereum whale operating back in the Satoshi era recently began to sell. In February 2016, this whale bought 16,636 ETH from ShapeShift for a mere $5.23 per ETH, according to data from Ember.

The whale started selling some of its holdings after weathering Ethereum's huge price spikes. At $2,340 they sold 350 ETH, generating a whopping 446x return. Ethereum is currently having difficulty sustaining its prior momentum, which coincides with this selling.

Ethereum has a weak ecosystem as a result of its poor performance and sharp decline in usage. The ETH/BTC ratio has fallen below 0.4 for the first time in three and a half years, suggesting that Ethereum is trailing behind Bitcoin.

Since many investors are avoiding Ethereum in favor of Bitcoin and other assets, this decline is indicative of the general mood among investors. The supply metrics for Ethereum also present a difficult picture. With only 135K ETH burned annually, the network is currently experiencing a low burn rate.

The developers of Ethereum had not anticipated a deflationary model like this. Rather than deflation, investors are concerned about Ethereum's supply growth, which is currently estimated to be 0.68% annually. Ethereum is still a major player in the blockchain industry despite these problems.

Its market position, however, might continue to suffer from low network activity and a lack of useful updates or developments to spark curiosity. Unfortunately, developers could not bring a new technology to the table that would disrupt the market, like NFTs and DeFi did back in 2021. There was some talk about the potential growth of RWAs prior to the Bitcoin halving, but it seems like the market did not catch up.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin