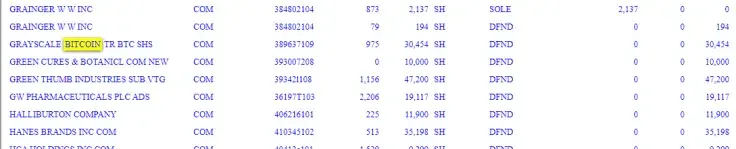

According to its new SEC filing, financial services company Rothschild Investment Corporation now holds 30,454 shares of Grayscale Bitcoin Trust (GBTC) that allows institutional investors to get exposure to the world's largest cryptocurrency without directly owning it.

This represents a 24 percent increase from October when the crypto king was trading well below $20,000.

No ties to the famous banking family

Founded by Monroe Rothschild in 1908, Rothschild Investment Corporation has been around for several generations of entrepreneurs.

The Chicago-based investment management firm first disclosed its exposure to Bitcoin back in mid-2017. It started off with a relatively modest investment of 539 GBTC shares that were worth only $200,000.

It should be noted that Rothschild Investment Corporation is not related to the famous family with the same surname.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov