The investment guru and author of ‘Rich Dad, Poor Dad’, a book on financial competence, Robert Kiyosaki, has again been tweeting about Bitcoin, silver (XAG) and gold (XAU).

He insists that BTC and these precious metals are getting stronger while the Fed keeps printing new ‘fake USD’.

'Bitcoin is becoming stronger, harder, more real'

The renowned real-estate investor and investment educator has taken to social media again in order to address frequent questions about why he keeps tweeting about Bitcoin in a positive tone.

The answer here, he says, is that he does not trust the current actions of the US Fed Reserve, Wall Street and Treasury due to the continuous bailout program they have been conducting for banks and corporations.

He calls the trillions of newly printed USD fake and says that Bitcoin, XAU and XAG can be trusted since they cannot be controlled by the aforementioned financial organizations.

He says that the more ‘fake USD’ the Fed prints, the stronger Bitcoin, gold and silver become.

Q: Why do I say buy, gold, silver&Bitcoin? A: Because I do not trust the Fed, Treasury, or Wall Street. Game of $ rigged in their favor. Gold, silver, Bitcoin are outside their control. As Fed prints trillions in Fake $ Gold, Silver& Bitcoin become harder, stronger, more real.

— therealkiyosaki (@theRealKiyosaki) May 27, 2020Advertisement

Fed is purchasing corporate bonds, supporting Wall Street

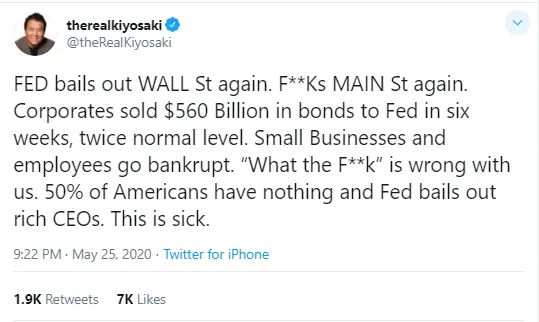

Another issue Robert Kiyosaki has with the Fed is their program on buying bonds and ETFs that was announced earlier in May.

The ‘Rich Dad, Poor Dad’ author wrote that within just over a month, the Fed bought $560 bln worth of corporate bonds – twice the normal level, he points out.

In the meantime, Kiyosaki says, small businesses and regular employees are going bankrupt.

Kiyosaki criticized the Fed's initiative to purchase ETFs, saying that when Japan was doing the same back in the nineties to support its economy, the US found it ridiculous.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov