Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

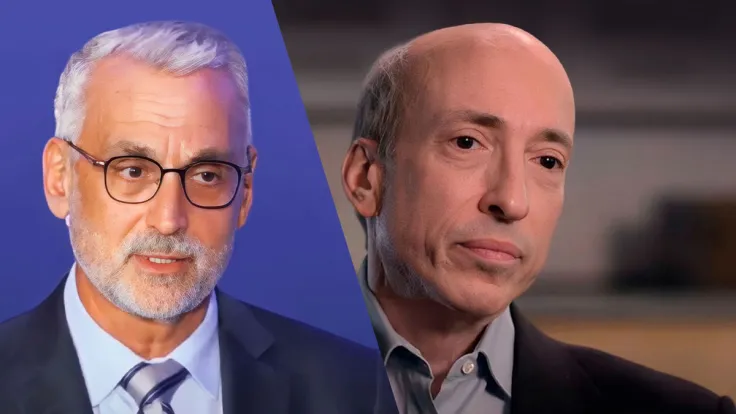

Ripple chief legal counsel Stuart Alderoty took a subtle jab at SEC chair Gary Gensler in a new tweet. Alderoty was reacting to a segment of the SEC chair's recent testimony before the U.S. House Financial Committee.

Gary Gensler, the chairman of the Securities and Exchange Commission, testified before the House Financial Committee on Sept. 27.

The SEC chair was grilled by the lawmakers on a variety of topics, and he was criticized for evading questions about cryptocurrency and stifling U.S. capital markets with regulations.

Stuart Alderoty, Ripple's senior lawyer, caught the part where the SEC chair was challenged by Representative Torres over the term "investment contract," which is critical for evaluating the SEC's authority over crypto.

According to the lawmaker, Gensler struggled to answer basic questions like whether an investment contract requires a contract, and his evasions were "deafening and damning."

Torres challenged Gensler by questioning if buying a tangible Pokemon trading card is a securities transaction, a question the SEC chair was seemingly taken aback by.

Alderoty praised the dexterity with which the SEC chair was grilled by the lawmaker. He took a jab at the SEC chair, saying he "didn’t know what hit him until it was too late."

A day before the testimony, Alderoty expressed expectations regarding the hearing, stating, "The SEC Chair will go to Congress tomorrow and lie by stating that there is such a thing as a crypto asset securities market and tokens themselves are investment contracts."

In his testimony, the SEC chair, as expected, referred to the cryptocurrency market as the "crypto asset securities market." He also reiterated his position that most crypto assets pass the investment contract test, also known as the "Howey Test."

Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun