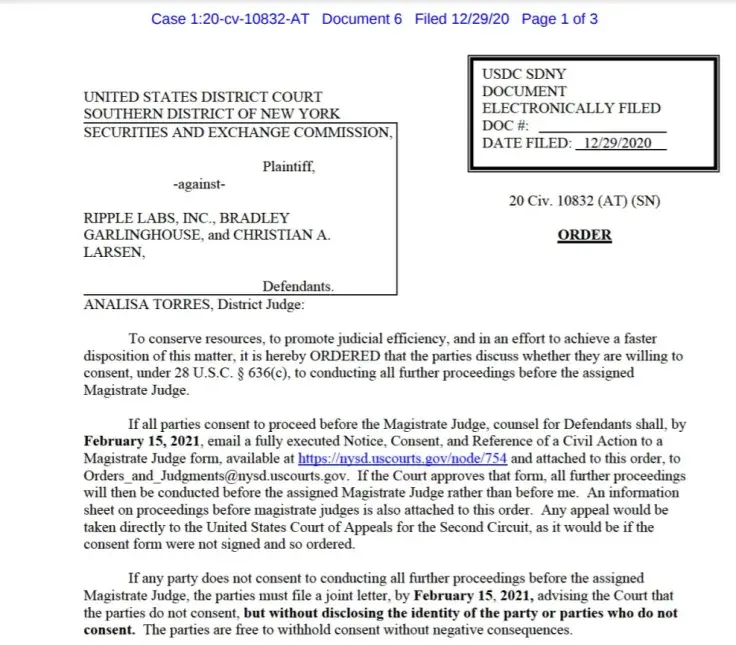

U.S. District Judge Analisa Torres has asked Ripple and the U.S. Securities and Exchange Commission (SEC) whether they are willing to consent to a magistrate judge to "conserve resources" and "promote judicial efficiency.”

This could potentially allow the case—which is expected to take over a year to resolve—to move more quickly.

If either Ripple or the SEC disagrees, both of the parties have to file a joint letter about withholding their consent.

As explained by Jake Chervinsky, general counsel for Compound, the parties are automatically asked to use a magistrate judge since this is a standard court procedure. On the off chance that both parties consent, this is unlikely to alter the timeline of the case.

The parties in every single case are automatically asked if they want to consent to a magistrate judge. Literally every single case. The SEC won't consent. I doubt Ripple will either. Even if they did, it wouldn't really affect the timeline of the case.

Lawyer Jesse Hynes says that the case is likely to drag out until at least Q4, 2021:

If the SEC and Ripple agree to use a magistrate judge, the timeline that I outlined previously could be expedited. I still wouldn’t imagine that there would be any resolution to this case until at the very earliest the last quarter of 2021.

Advertisement

Ripple is ready to defend itself

With exchanges delisting XRP or suspending trading in droves next month, the upcoming court battle between Ripple and the SEC will definitely be on everyone's radar in 2021.

In its most recent public statement, Ripple mentioned that it was looking forward to settling the SEC lawsuit in court:

For eight years, we’ve built products that help hundreds of customers solve pain points around global payments—we will defend our company and look forward to settling this matter in court to finally get clarity for the U.S. crypto industry.

As reported by U.Today, a virtual pretrial conference in the case has been scheduled for Feb. 22, 2021.

Ripple was sued by the SEC over allegedly illegal XRP sales on Dec. 22.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov