The Reserve Bank of India (RBI) is reportedly mulling over developing the digital version of the Indian rupee, according to The Economic Times.

In its new booklet—which is cited in the report—the central bank says that it is "exploring the possibility" of whether or not there is a need for digital cash despite major skepticism toward cryptocurrencies among local regulators:

Private digital currencies (PDCs) / virtual currencies (VCs) / cryptocurrencies (CCs) have gained popularity in recent years. In India, the regulators and governments have been skeptical about these currencies and are apprehensive about the associated risks. Nevertheless, a lack of regulatory clarity prevents the local cryptocurrency industry from moving forward. Since crypto is not recognized as legal tender, exchanges and other related businesses are having a hard time operating in the country.

Baby steps

India has been rather apprehensive of crypto. Back in April 2018, RBI imposed the infamous ban on cryptocurrency transactions that was eventually overturned by the country's Supreme Court last March.

While plenty of countries such as Sweden and China are already testing their central bank digital currencies (CBDCs), India has been mostly on the sidelines. It started exploring the feasibility of digital money back in August 2018 but has barely made any progress since.

In December 2019, RBI governor Shaktikanta Das said that the discussions were at a "very incipient stage."

An emerging cashless society

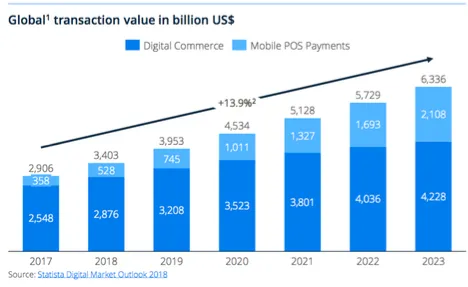

In the meantime, India is moving closer to becoming a cashless economy. On Jan. 1, RBI launched the Digital Payments Index (DPI) that, as the name suggests, measures the pace of the economy's digitization.

The volume of digital payments is expected to increase three-fold in four years in India, with the raging pandemic giving them a significant stimulus.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov